Insurance Plans – This saying also applies to modern nuclear families who are ambitious, independent and optimistic about the future. People are now more vulnerable than ever, given the increase in the incidence of new diseases caused by lifestyle changes, the emergence of new viruses and environmental changes. Nuclear families, unlike earlier joint families, have a thin support system, where relatives could step forward to help if someone fell ill.

The rising costs of hospital admissions are becoming a new challenge for the growing middle class, which is not seeing pace with income growth. In a family with two children, even if one child gets sick, both parents need to be around to care for the child and do housework. Even if one parent falls ill, the other parent must take on additional responsibilities to keep the household running smoothly. There are also opportunity costs involved that make healthcare more stressful. Therefore, it is important to take care of the health of everyone in the family and this makes health insurance an essential financial tool.

Contents

- Insurance Plans

- Comprehensive Breakdown To Insurance Plans

- Health Insurance: Plans & Policies In India

- Top Health Insurance Companies & It’s Health Plans

- Life Insurance Plans

- Health Insurance Policy Online, 3d Isometric Vector Illustration. Medical Insurance Plan Concept With Doctor, Patient, Medical Form With Shield, Pills On Mobile Screen, Calculator, Piggy Bank, Money. Stock Vektorgrafik

- Online Term Plan: Buy Flexi Online Term Insurance Plan

- Best Health Insurance Plans With No Copayment: Pros And Cons

- Health Insurance Plans ‘too Complicated To Understand’

- Health Insurance Plan Types Stock Vector

- Gallery for Insurance Plans

- Related posts:

Insurance Plans

The current situation is proof enough that emergencies can strike at any time and that the emergence of new diseases makes life even more precarious. No age group is ‘safe’ from unknown diseases and it is wise to be prepared for such setbacks.

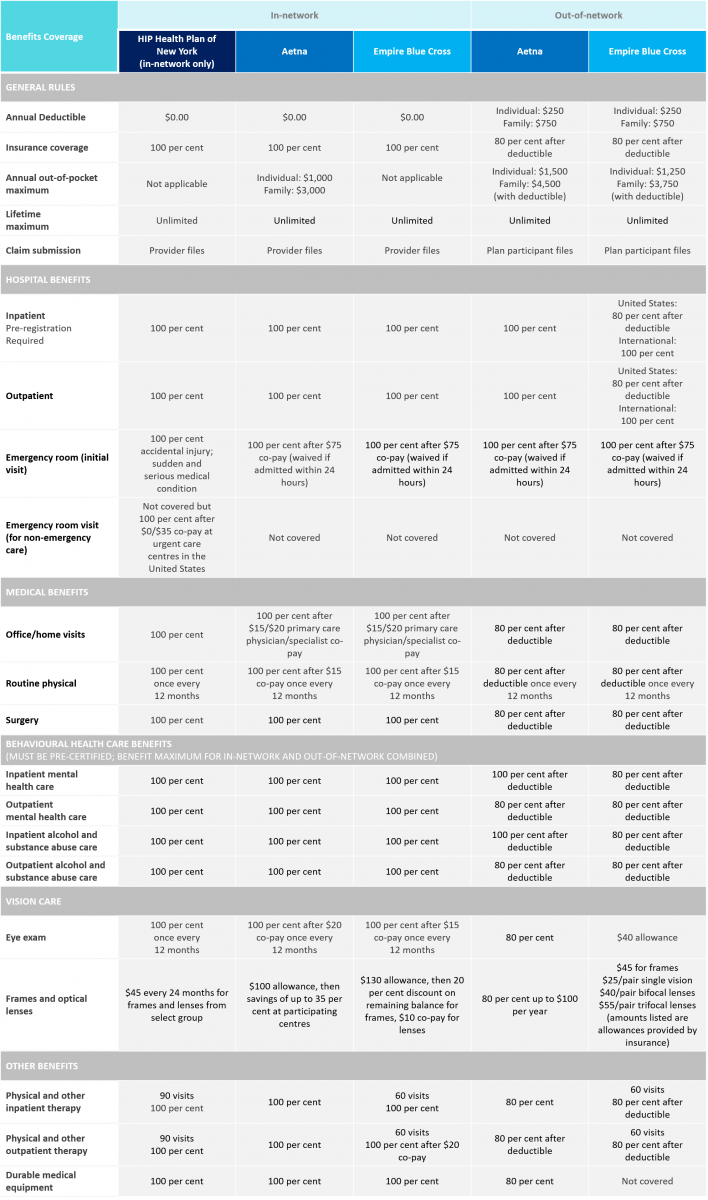

Comprehensive Breakdown To Insurance Plans

As the name suggests, this insurance provides umbrella coverage for the entire family. It is a comprehensive health insurance plan with extensive features such as preventive health checkups, cashless hospitalization option, long-term fixed premium, etc.

Umbrella cover provides a fixed sum insured for the family. It is also difficult to manage multiple policies and there is a chance that premium payments may be forgotten, resulting in cancellation of the policy. It is more convenient to manage one policy.

Family coverage protects everyone in your family, providing financial security in times of need and saving you the double stress of dealing with the disease and its associated costs.

There are many benefits to choosing family health insurance. Below are some good reasons.

Health Insurance: Plans & Policies In India

With the rising cost of healthcare, especially after the outbreak of COVID-19, family health insurance seems like a good option to protect your family as it is much cheaper than buying individual insurance coverage for each family member.

It can be difficult to renew four policies on four different dates. Maintaining and updating data can cause problems. If you only have one policy, you can renew it in one go and the chance of forgetting it is very small. The insurer may offer you some additional benefits if you opt for family cover.

When submitting your tax planning file or investment declaration, you can only consult one policy for tax deductions (instead of four different policies). The amount paid for health insurance cover is eligible for deduction under Section 80D of the Indian Income Tax Act.

When a new member joins your family, you do not need to take out a new policy. The child’s name can be added to the existing policy. You also have the option to add your parents or parents-in-law to the family health insurance.

Top Health Insurance Companies & It’s Health Plans

Additional coverage for maternity, accident and/or serious illness is also available, so that the insured family can receive a lump sum for additional costs in addition to reimbursement of hospitalization costs.

1. Pre-existing diseases: Insurance, by definition, covers the risk of something that is not yet known. Health insurance is a financial protection against any illness that may arise in the future. Therefore, the question does not arise whether it concerns “pre-existing”, i.e. any known disease. However, for the benefit of customers, some health insurance plans cover pre-existing health conditions, with a reasonable waiting period.

2. Cosmetic Makeover: This is a common exclusion that prevents customers from claiming expenses incurred for undergoing cosmetic changes not prescribed by doctors. Plastic surgery performed solely to improve appearance is not reimbursed, but plastic surgery after an accident may be covered by health insurance.

3. Suicide Attempt: Injuries caused by a suicide attempt are not covered by most health insurance policies.

Life Insurance Plans

4. Alternative medicine: Treatments that fall under naturopathy, homeopathy, etc. may not be covered by standard health insurance policies.

5. OPD: Consultations and treatments at the outpatient clinic are not covered, unless these treatments are part of pre- or post-hospitalization.

While the exclusions in standard healthcare plans are more or less the same, the inclusions may vary depending on the insurer, the type of policy, the sum assured and the premium payable. Here’s a ready-made calculation of what’s broadly covered by most plans:

A) Hospital admission: Inpatient treatment includes costs such as surgery, operating room costs, nursing costs, anesthesiologist fees, costs of medicines, blood and oxygen.

Health Insurance Policy Online, 3d Isometric Vector Illustration. Medical Insurance Plan Concept With Doctor, Patient, Medical Form With Shield, Pills On Mobile Screen, Calculator, Piggy Bank, Money. Stock Vektorgrafik

B) Before and after hospital admission: Any consultation or examination done before hospital admission is covered by the policy. Any follow-up consultations, medications and examinations after a hospital admission are also reimbursed. Both costs are only covered for a certain period (for example: 60 days before and 60 days after hospital admission)

C) Ambulance: The cost of transporting the insured for hospital admission/admission is covered, although some policies may have upper limits.

D) Day care: Nowadays, many treatments do not require hospitalization for several days. At the same time, these diseases are both serious and expensive. Such costs are covered by health insurance.

You can also benefit by saving tax on the premium amount paid as the premium amount is deductible under Section 80D of the Indian Income Tax Act. This is in addition to the deduction claimed under Section 80C of the Indian Income Tax Act.

Online Term Plan: Buy Flexi Online Term Insurance Plan

You can avail separate Section 80D deduction for your family and parents if you both pay premiums. This is regardless of whether you have one policy that covers all insurance policies, or several.

For example, if you have single-family insurance for yourself, your partner, children (under 25) and parents, you can receive twice the 80D benefit.

Section 80D allows a maximum deduction of Rs 25,000 if the insured person is below 60 years of age. The deductible goes up to Rs 50,000 for an insured person above 60 years of age. This limit covers the cost of preventive medical check-ups up to Rs 5,000.

You can also apply for an 80D benefit for medical expenses for certain illnesses for a senior (for yourself or your parents).

Best Health Insurance Plans With No Copayment: Pros And Cons

It goes without saying that a family health plan is more comprehensive and affordable than an individual health plan. Furthermore, it is easier to manage one plan than to manage multiple policies.

Family health insurance relieves stress, offers first-class benefits and allows you to live in peace. Investing in a family health plan is important, which is why you should make this decision as soon as possible.

Disclaimer: This article is published in general public interest and is for general information purposes only. Readers are advised to exercise caution and not rely on the content of the article as convincing. Readers should do further research on this matter or consult an expert.

Tags Life Insurance Term ULIP Tax Savings Health Insurance Child Insurance Pension Tax University Savings Plan Guaranteed Savings Plan Guaranteed Income4Life Plan

Health Insurance Plans ‘too Complicated To Understand’

I agree that even though my contact number is registered with NDNC/NCPR, I still want the company to contact me at the number and email address provided for my requested clarification/product information and agree that go with privacy policy Have read and understood. Policy and agree to abide by it.

Health Insurance for Families Health Insurance Benefits of Health Insurance for Seniors Why You Should Buy Critical Illness Insurance Short Term Health Insurance for 20 Years Difference Between Life and Health Insurance When to Buy Health Insurance Between Term and Health Insurance Difference What is Health Insurance What is Health Insurance Comprehensive Health Insurance, Health Insurance for Covid-19, Health Insurance for Knee Replacement Surgery, Accident Coverage in Simple Life Insurance, Tips to Buy Health Insurance

I agree that even though my contact number is registered with NDNC/NCPR, I still want the company to contact me at the number and email address provided for my requested clarification/product information and agree that go with privacy policy Have read and understood. Policy and agree to abide by it.

I authorize the company to contact me via email, phone, WhatsApp or any other means for clarifications/product information, overriding my registration on NDNC/NCPR. I have read, understood and agree to the privacy policy. A new study from UConn Health’s Health Disparities Institute shows that many patients in Connecticut are struggling to understand their complex, jargon-filled private health insurance plans.

Health Insurance Plan Types Stock Vector

A new study from UConn Health’s Health Disparities Institute shows that many patients in Connecticut are struggling to understand their complex, jargon-filled private health insurance plans. (Shutterstock photo)

A new study conducted by experts at UConn Health’s Health Disparities Institute finds that many patients in Connecticut are having trouble understanding their complex, jargon-filled private health insurance plans.

Employer insurance plans, small group insurance plans, medicare supplemental insurance plans, medigap insurance plans, visitor insurance plans, small company insurance plans, family life insurance plans, business insurance plans, company insurance plans, employee insurance plans, life insurance plans, short term insurance plans