Life Insurance For Seniors – We all want to protect and financially support our loved ones and improve our lives, and life insurance is the best way to do that. Life insurance can help you support your family and friends even after your death. Although buying life insurance earlier in life is always recommended because it has certain benefits, it can be obtained even if you are a citizen.

Deciding whether you need life insurance is the easy part; It’s more complicated: what type of insurance should seniors get? Choosing a life insurance plan determines your life benefit and the help your family will receive in the event of your death.

Contents

- Life Insurance For Seniors

- Understanding The Major Types Of Life Insurance Plans

- Best No Exam Life Insurance Companies Of November 2023

- Best Life Insurance For Seniors In 2020: Top 5 Companies

- Best Life Insurance For Seniors In California

- Life Insurance For Seniors Over 60 (2023)

- Life Insurance For Seniors

- The Best Life Insurance For Seniors In Canada » Smartwealth Financial Incorporated

- Should Seniors Cash Out Their Life Insurance Policy?

- Best Life Insurance For Seniors

- Gallery for Life Insurance For Seniors

- Related posts:

Life Insurance For Seniors

Everyone has a type of life insurance that’s right for them, and we want to help you find the right one for you. In this article we will talk about:

Understanding The Major Types Of Life Insurance Plans

Another feature of life insurance policies is that people benefit while they are still alive. There are different benefits to different policies, but here is a list of reasons why people want to buy life insurance:

Therefore, everyone in the country can benefit from life insurance in any of these areas. Many people choose to take out life insurance for senior citizens because their spouses do not receive a pension after death due to lack of life benefits. Therefore, life insurance can provide financial support to your spouse even if you are gone.

Senior life insurance looks different in some ways, but works the same way as term life insurance. Seniors can choose between whole life, whole life and whole life insurance.

This may vary from company to company, but most life insurance companies offer life insurance for up to 80 years. However, the level period becomes shorter, especially when you enter the age of 50.

Best No Exam Life Insurance Companies Of November 2023

When it comes to whole life policies, you can get it at age 85, but some insurers offer a lower age limit.

The most important step in choosing life insurance is to research and understand the various options. It can be confusing because there are so many life insurance options out there.

With that said, we’ll discuss the most popular life insurance options and explain how each one works and their pros and cons. You decide the best life insurance for you and your family based on your goals and needs.

Annuity insurance pays a benefit if the policyholder dies during the policy period. This type of term is called because it lasts for a period of time, from one year to 30 years.

Best Life Insurance For Seniors In 2020: Top 5 Companies

People buy this insurance in lieu of money. This way, they can support them pay off their mortgage (and other personal debt) or help them cover the years their children or grandchildren graduate from college.

One of the biggest advantages of life insurance is that it is cheap and easy to understand and use. However, it is not the same when you get your life insurance at age 20 and age 60.

The difference is in your health. To get long term life insurance, you must undergo a medical examination. Of course, for people who do not have health problems, this is not a problem.

In short, if you are in good health for your age and want to pay premiums for a long time, a whole life policy is possible. However, you should research all the terms available because there are many: term life insurance, term life insurance renewal, premium level, etc.

Best Life Insurance For Seniors In California

If you are in your 60s or 70s and looking for long-term life insurance, it is important to know that you can get a 10-20-year term life insurance policy. And if you’re over 80, most life insurance companies won’t give you a quote.

Whole life insurance is a type of permanent life insurance, which means that the policy holder is insured if the life insurance premiums are paid on time. In addition, there is a type of cash value life insurance that supports you in building cash value.

According to the Insurance Information Institute, whole life is the most sold, one of the best life insurance policies, with the most permanent type of coverage. Other types are variable life insurance and whole life insurance.

The main advantage of universal policies is that they are unique and personalized because the policy depends on the illness, medical history and the level of cover required.

Life Insurance For Seniors Over 60 (2023)

Because whole life insurance has a cash value component, it accumulates cash value over time, and you can take out cash or take out a loan for that value. This policy is more expensive than a whole life policy, but you have the option to build cash value by rolling over your policy and leaving a legacy to your family.

Whole life insurance pays benefits even if the policyholder dies, as long as the policy is still in force. When purchasing whole life insurance as a senior, healthy men should expect to pay $1,122 to $2,089 per month for a $250,000 death benefit. For healthy women, this amount is between $934 and $1,801 per month.

For seniors, there is also the option of buying life insurance for last-minute payments. It’s a lifestyle, usually without a medical exam – you answer a few health questions in the application. This results in lower premiums, and many people consider it to be one of the best life insurance policies.

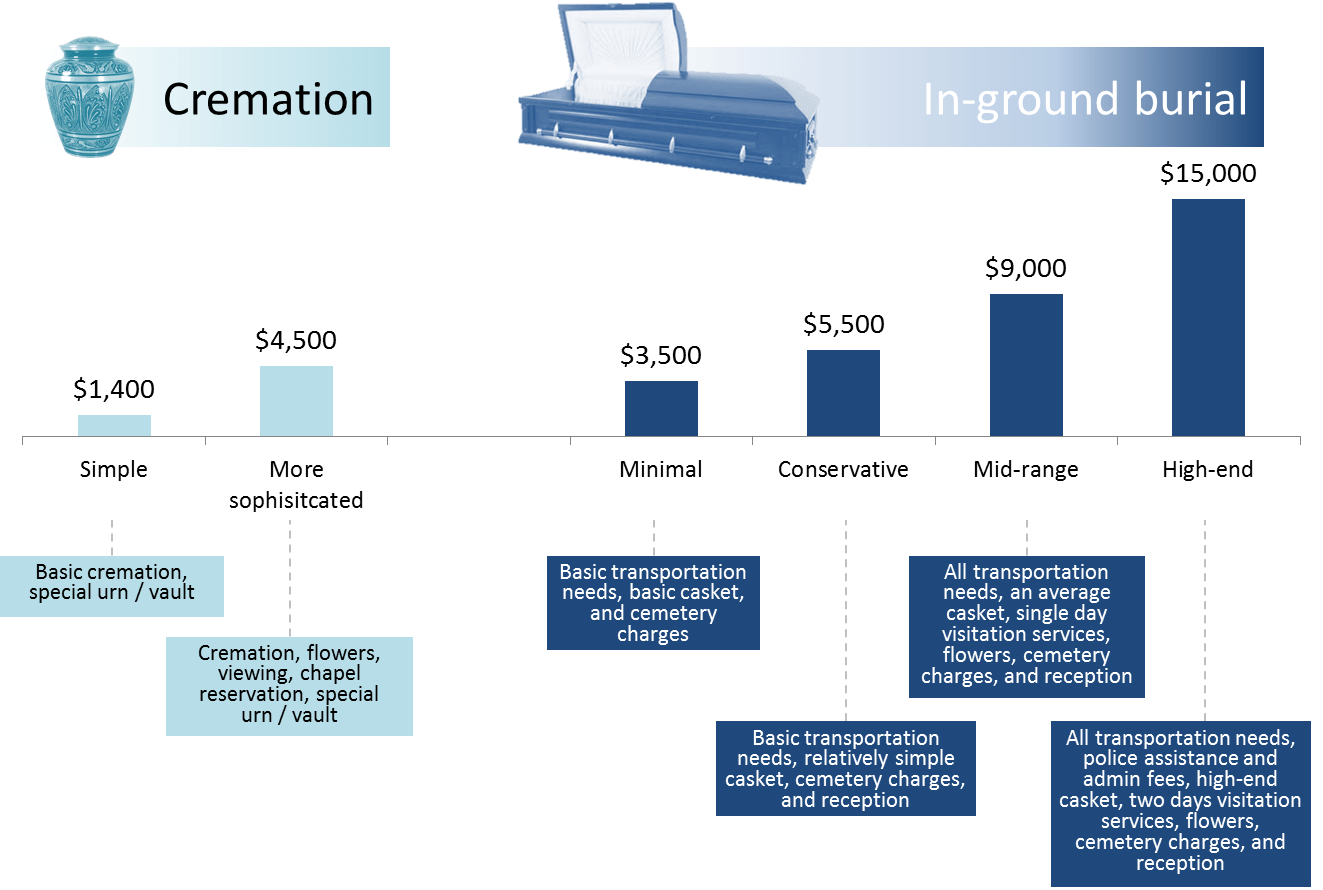

Another type of life insurance for seniors is funeral insurance, also known as emergency insurance. This insurance is usually purchased from funeral homes and the payment goes directly to the funeral home to cover the costs of pre-arranged services.

Life Insurance For Seniors

Advance insurance is different from last expense insurance (or funeral insurance) because it only pays for your funeral. Funeral insurance, on the other hand, pays death benefits to beneficiaries who use them as they wish.

The advantage of this type of senior insurance is that your family does not have to worry about paying the final expenses as it is covered automatically. The downside is that there are no other options – no death benefits or premiums.

Last expense insurance or funeral insurance is whole life insurance without a medical exam, usually between $2,000 and $40,000. The policy premium covers funeral expenses, medical bills, or credit card debt.

One of the benefits that seniors love about last expense insurance is that you don’t have to live to qualify and just answer a few health questions. Final payment insurance is term life insurance with a fixed payout for life. In addition, the benefit of the disease is not reduced, and the cash value increases over time.

The Best Life Insurance For Seniors In Canada » Smartwealth Financial Incorporated

The average monthly salary ranges from $50 to $150 in the $10,000-$15,000 range. As always, prices will vary depending on your age, gender, lifestyle and the amount of cover you are purchasing.

Universal life, also known as adjustable life, can be more flexible than a whole life policy. With universal life insurance, you have options to lower or skip premiums.

This allows the value of the policy to increase at a slower rate because the expenses are covered by the present cash value. If you have a chronic illness or illness that makes it difficult to qualify for term or whole life insurance, universal life insurance is something to consider as a third option. People who opt for this option go through an underwriting process, just like buying a senior life insurance policy.

Some seniors never try for insurance because they think they won’t be accepted because of their age or health. But they are wrong.

Should Seniors Cash Out Their Life Insurance Policy?

There have been many improvements in insurance underwriting and the availability of private insurers to cover higher risk individuals. So life insurance is available to everyone. For those who are seriously ill, there is an option to get a policy without medical examination. It’s meant for small politicians, but it’s still a good place.

Based on the answers to the health questions in the application, there is a final payment insurance. It is important that you answer all questions truthfully when applying for your life insurance to be issued correctly. If a person misrepresents the truth, some insurance companies will cancel the policy or even deny the death benefits if the information is incorrect.

Guaranteed life insurance is a type of permanent life insurance that does not require you to answer medical questions, undergo a medical exam, or allow the insurance company to see your medical and prescription records. For this reason, many people call it “no-dual life insurance” or “no-dual unlimited expense insurance”.

While this is good, there is a catch. Life insurance and eligibility issues have a waiting period. If the person dies while waiting, the beneficiaries will not receive the full death benefit. The waiting period is usually two to three years. However, beneficiaries receive all payments plus interest, usually 10%. So the recipients still get something, but less than planned.

Best Life Insurance For Seniors

Guaranteed life insurance

Life insurance seniors, life insurance policy for seniors, guaranteed life insurance for seniors, gerber life insurance for seniors, term life insurance for seniors, 100k life insurance for seniors, prudential life insurance for seniors, life insurance quotes for seniors, globe life insurance for seniors, aarp life insurance for seniors, affordable life insurance for seniors, whole life insurance for seniors