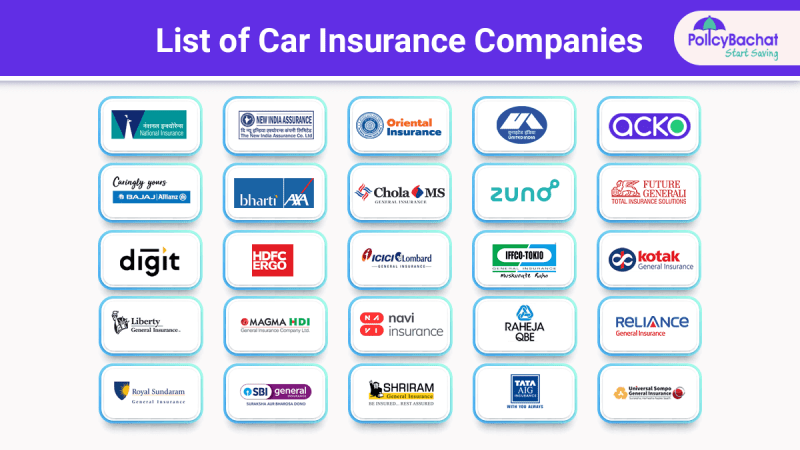

Motor Insurance Companies – When people learn that we rank insurance companies based on price, coverage and service, they keep asking the same question: “what is the best car insurance company?” Naturally, they expect us to mention one of the companies that spend billions a year on advertising. However, as the infographic shows, there is no easy answer to that question.

One of the reasons this is a difficult question to answer is that companies with a lot of advertising are rarely successful. The fact that local companies tend to have good ratings leads to negotiations. It is not an easy answer. Therefore, we find the answer to their question in the question. Our question is, “Where do you live?”

Contents

Motor Insurance Companies

Want to find the best car insurance companies? Click below and go to your state. We list the best places to stay in one place. This list is updated regularly.

Compare Motor Insurance Online

We listen and understand that people want to know what insurance companies are good and bad. Therefore, a website that shows people what different insurance companies are like is exactly what we have developed. Then we created one better than that. To help every driver find the best car insurance, we publish an analysis of the best companies, state by state.

Currently, there is no great news for insurance buyers. Important information can only be obtained from insurance companies. Then everything changed. collecting and analyzing millions of data necessary to find the best car insurance companies.

We don’t just collect and analyze data, we make it easy to understand. The scale on the left shows the standard company. Anyone with formula that has needles on the left side of the center should have good insurance. Best of all, anyone can get free points.

This is important information. Many people are surprised to learn that companies with large marketing budgets are not efficient when it comes to protecting their customers. There is a reason for that. If the money is spent on advertising, it is not available for policyholder protection.

Top 5 Motor Insurance Companies In India 2021 22

The insurance industry made a fool of themselves by buying the products they sell. From a business perspective, selling your products is not a good idea. But, as we all know, it seems that other advertisements are insurance. Many ads talk about how this company can get a good price. Good price? Consumers are looking for the best price.

Solve that problem. We’ve created a car insurance calculator to help you find the right price. Surprisingly, the price or coverage can, and does, vary greatly. Use the calculator to find out if you’re getting the best price. Just click on the button below. Insurance rates vary – a lot – by state. Therefore, we have created a car insurance color chart for each of the 50 states.

About Dan Karr Dan has over 20 years experience as a CEO or vice president of technology companies. While working as the Senior Vice President of Marketing and Sales for a technology company, Dan was seriously injured on the job. After struggling to find insurance companies to pay for the large medical bills, or to settle the case so that Dan could pay his bills, he began to understand the problems of insurance. Dan is dedicated to delivering his experience by bringing consumers, insurance agents and financial advisors easy-to-understand information to identify insurance companies that offer the best value, protection — problem solving — and service. Stores & Industries. The market is divided into the form of insurance (three categories of obligations and their definition) and the form of distribution (agents, intermediaries, banks, intermediaries, online, and other distribution channels). Market size and data are provided in USD (USD) for all categories listed above.

The car insurance market in Singapore generated revenue of USD 860 million this year and is expected to register a CAGR of 2% during the forecast period. Last year, the gross domestic product (GDP) of the financial and insurance industry in Singapore was about 73 billion Singapore dollars.

Motor Insurance Company In The Philippines

The COVID-19 pandemic has had a significant impact on various sectors, including the car insurance market in Singapore. During the pandemic, lockdowns, travel bans, and work-from-home arrangements have led to reduced car use. With fewer cars on the road, there has been a corresponding reduction in the number of insurance claims. This has led to a reduction in costs for insurance companies. In response to the outbreak, regulatory agencies may introduce temporary measures or policy changes to support insurers and insurers. These changes may include increasing coverage, simplifying record requirements, or implementing assistance to ease the financial burden on policyholders.

Singapore wants to develop the insurance industry in Asia. Among the different types of insurance in Singapore, car insurance is one of the biggest. Various insurance companies have begun to work closely with partners and partners such as the Singapore Road Safety Council and the Singapore Road Safety Police to promote education and awareness for road users in Singapore. Sales of motor vehicles have improved post-covid, indicating increased consumer demand, which is expected to help the insurer’s growth in the short term. There has been an increase in the number of insurance companies, especially in the last two years, run by professional and indirect business owners.

Additionally, sales of electric vehicles have increased over the past 2 years, which has had a significant impact on auto insurance. In addition, the increasing eco-friendliness of Singaporean consumers will help the EV insurance market. This strong demand for electric vehicles is expected to increase demand for new insurance policies, thus encouraging the development of the insurance market in Singapore.

The impressive performance of the fire insurance sector attests to the effectiveness of the government’s schemes. The group posted earnings to reverse the loss reported last year. The demand for motor vehicles in Singapore has increased significantly due to urbanization and increasing consumer demand. In Singapore there is a wide expansion of the car industry because of the car sales, because the car industry is supported by many factors such as manpower, R&D effort, geography, and government. This is due to the innovation and use of technology implemented by the companies, and the insurance association works to reduce operational costs, improve efficiency, and reduce the impact of fraudulent claims.

Car Insurance Dubai, Uae

Insurance was hard to come by, especially in the city-state. Singapore is one of the busiest insurance markets in the world – measured by gross domestic product (GWP) as a percentage of gross domestic product (GDP). The report was submitted to issuers that accounted for more than 45 percent of GWP, an annual percent increase in the general insurance market. Additionally, traditional channels through agents and financial advisors continue to be the best way for local customers to purchase their policies. In a mature market with strong support staff,

Insurtech companies in Singapore have faced a challenge. However, they played well. Insurtech in Singapore dominates the car insurance market. More than 80 insurtechs are registered with the Singapore Fintech Association. And there is no shortage of investment in the sector. According to BCG, financing of local Insurtech companies will generate 29 percent of private investment by 2021. Many insurtechs in Singapore are looking to change this story through system offerings. Bolttech is one example. Under the leadership of Richard Li’s Pacific Century Group (PCG), the Singapore-based company is the world’s largest stock exchange, which it says has managed $5 billion, with more than 5,000 products and companies. ‘150 insurance on its website. Leveraging PCG’s strengths in the insurance space – FWD Insurance is a venture capital firm – Boltech was able to serve more than 7.7 million customers in the year to 2020. It recently received US$180 million in Series A funding. found the company valued at more than USD 1 billion. While Bolttech’s impressive figures give local Insurtechs a picture of the size of the global Insurtech market they can expect, we shouldn’t underestimate the fact that they are backed by a strong company as PCG has raised the bar for Bolttech. Therefore, it is clear that Insurtechs have a role in Singapore’s insurance industry.

The car insurance market in Singapore is very saturated in nature in terms of market share. Some major players currently dominate the market. The market is likely to rise during the forecast period due to the increase in the automobile sales and many other factors that drive the market. Some of the major players in the market are Msig Insurance (Singapore) Pte. Ltd, Tokio Marine Life Insurance Singapore Ltd, Oriental Life Insurance Company, Aviva Ltd, and

Motor cycle insurance companies, motor vehicle insurance companies, motor trade insurance companies, list motor insurance companies, motor carrier insurance companies, motor companies, best motor insurance companies, motor insurance companies uk, motor insurance companies ireland, motor insurance companies in usa, motor truck cargo insurance companies, top motor insurance companies