Nj Car Insurance – Home » Compare Car Insurance Rates by State » Compare Car Insurance Rates in New Jersey » Compare Car Insurance Rates in New Jersey [2023]

Compare New Jersey Car Insurance Rates [2023] New Jersey drivers are required by law to have 15/30/5 liability insurance to drive, which costs an average of $76 per month. However, you can compare New Jersey car insurance rates and find a better deal, especially if you purchase comprehensive coverage for an average of $132 per month.

Contents

- Nj Car Insurance

- Your Auto Insurance Bill Can Be Higher Based On Your Job, Education, Credit Score. N.j. Senate Says It’s Discrimination.

- Nj Auto Insurance Is Expensive: Here’s How To Lower It

- Who Has The Cheapest Car Insurance In New Jersey?

- What You Need To Know About Car Insurance In Nj

- Car Inspections For Insurance: Everything You Need To Know

- Nj Car Insurance Rates May Rise After Murphy Signs Controversial Law

- Things Standard Car Insurance Doesn’t Cover

- Nj Gov Signs Car Insurance Law To Raise Minimum Liability Limits, Will Impact 1.1 Million Drivers

- Gallery for Nj Car Insurance

- Related posts:

Nj Car Insurance

Tracy L. Wells is a licensed insurance agent and owner of Farmers Insurance Agency with 23 years of experience. He is proud to be a local farmer’s representative serving Grayson, Georgia and the surrounding areas. With experience as both an underwriter and an agent, he provides clients with insight that other agents do not. His agency offers all types of insurance including home, life, auto, RV, …

Your Auto Insurance Bill Can Be Higher Based On Your Job, Education, Credit Score. N.j. Senate Says It’s Discrimination.

Scott W Johnson is an independent insurance agent in California. As the principal broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to our clients. His five President’s Council awards prove that he applies everything he has learned at Avocet, Sprint Nectel and Farmers Insurance to benefit his clients. Scott quickly realized the unique requirements of his insurance…

Advertiser Disclosure: We strive to help you make confident decisions about auto insurance. Comparison shopping should be easy. We are not affiliated with any car insurance company and cannot vouch for any one company’s offer.

Our affiliates do not influence our content. Our opinions are our own. Enter your zip code above using our free quote tool to compare quotes from top car companies. The more quotes you compare, the better your chances of saving.

Editor’s Note: We are a free online resource for anyone looking to learn more about auto insurance. Our goal is to be your go-to source for all things auto insurance. We update our site regularly and all content is reviewed by car insurance experts.

Nj Auto Insurance Is Expensive: Here’s How To Lower It

Because the minimum auto insurance required in New Jersey is expensive, it is even more important to compare and shop for New Jersey auto insurance quotes. However, the first thing you need to know is how much coverage you need in New Jersey, and what additional coverage you need before purchasing cheap auto insurance.

In our guide, we cover everything you need to know about buying affordable car insurance in New Jersey, from rates to laws. So when you’re ready to start looking for cheap auto insurance in New Jersey, you can use our free comparison tool.

Before we get into all the colorful options, it’s important to understand a little bit about New Jersey’s history as a failed state and how it stacks up against other failed states.

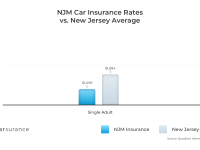

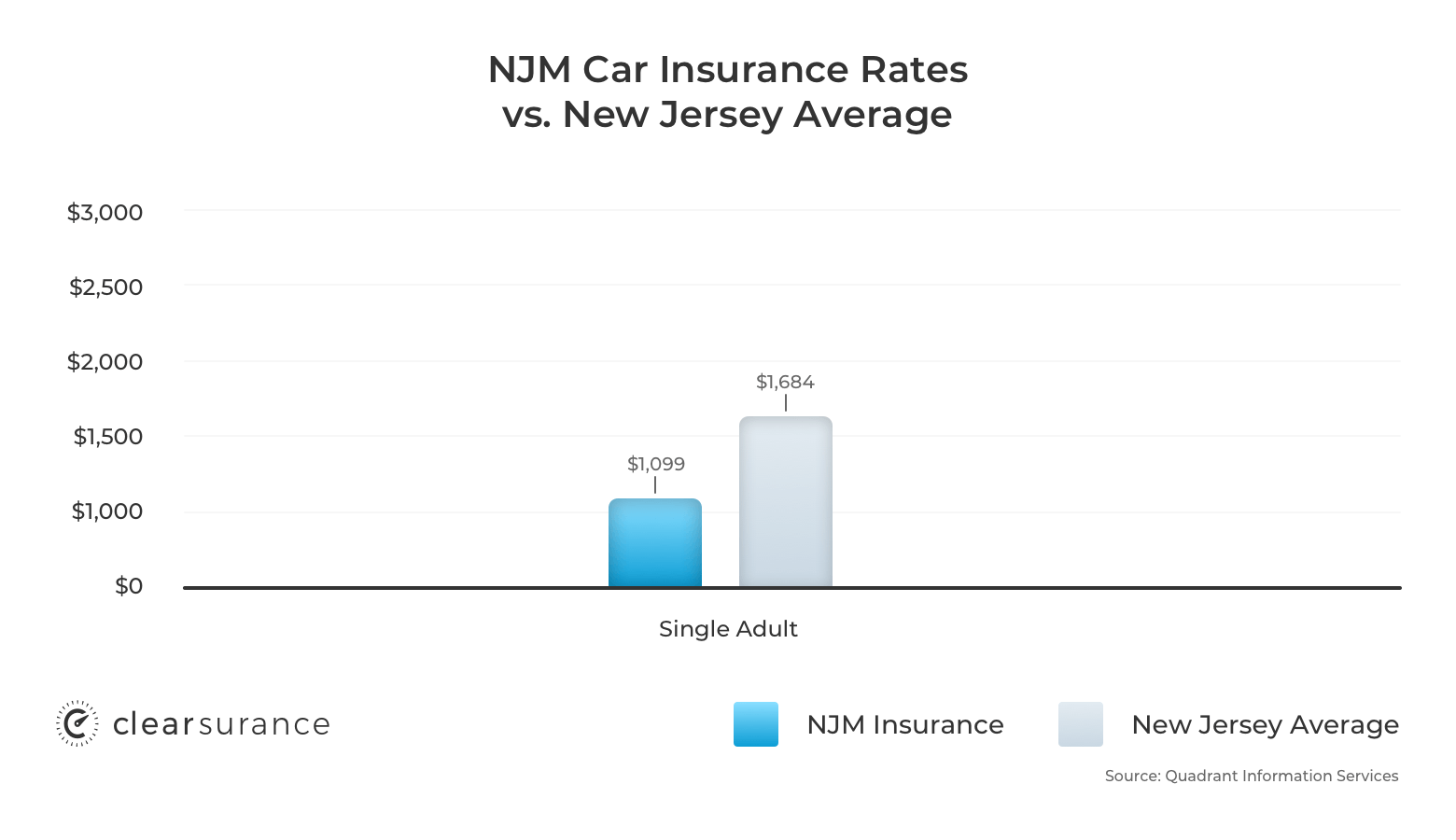

Despite the many options, auto insurance rates in New Jersey are still among the highest in the country.

Who Has The Cheapest Car Insurance In New Jersey?

Next, we’ll explain why the rates are so high and what options you have as a driver in New Jersey. For now, let’s get to the basics.

New Jersey is a “fault” state, meaning that drivers file claims with their own insurance company rather than filing a claim against another driver or a lawsuit, as in no-fault states.

Keeping lawsuits out of the legal system and providing necessary medical insurance after a catastrophic accident. Unlike other no-fault states, New Jersey allows drivers to pre-select the level of their right to sue (also known as limited damages or full damages) if they are seriously injured in an accident. Regardless of who is at fault, New Jersey requires you to move on

The first two amounts above are included in New Jersey personal injury coverage, so no matter what type of coverage you choose, at least these three amounts are required for personal injury protection and property damage liability. Wondering: Why do you need liability insurance if it doesn’t matter who is at fault? In New Jersey, liability insurance is useful if:

What You Need To Know About Car Insurance In Nj

If any or all of the above scenarios apply to you, you may want to consider increasing your minimum liability beyond what is required by law. See how coverage minimums in New Jersey compare to the rest of the US.

If it’s not liability insurance that’s driving such high prices, what is? Here are three main reasons why prices are so high in New Jersey. Next, we’ll explore options to lower the price.

Remember that “no fault” does not mean that no one is responsible for an accident. Officers will collect crime scene evidence that can be used in personal injury cases. No-fault means that drivers must contact their own insurance company in the event of an accident, injury or damage. about a car accident.

A large portion of your no-fault premium (regardless of the plan you choose) will go toward personal injury protection (PIP), with a maximum benefit of $250,000.

Car Inspections For Insurance: Everything You Need To Know

However, this basic no-fault policy will not pay for repairs to your vehicle. This is an optional scope (optional) that we will cover later. In at-fault states, personal injury coverage is not included and insurance companies assume that other drivers have at-fault coverage, so they only charge rates that reflect the statistical likelihood that the insured will hit another car.

New Jersey residents must pay a minimum of $15,000 to $250,000 per person for accident and personal injury coverage and coverage for all household members. Of course, the exact amount depends on the type of damage and the total number of people covered by your policy. PIP provides emergency assistance to people who have been injured in a car accident.

After a deductible of $200 to $2,500 of the first $5,000 of medical bills, personal injury coverage covers injuries (or damages caused by injuries) from year to year. Conclusion? If you or a family member is seriously injured in an accident, your insurance company must pay to allow for treatment and lost wages. Again, New Jersey offers deductibles and different levels of PIP coverage to lower premiums. We will explain these options a little later.

All insurance companies in New Jersey have what is called a loss ratio. The loss ratio shows how much money the company spends on claim types and how much money it takes in premiums. A loss ratio of 60 indicates that the company spends $60 for every $100 it earns in commissions.

Nj Car Insurance Rates May Rise After Murphy Signs Controversial Law

So, the closer this ratio is to 100, the more claims will be paid; but it also shows that insurance companies are suffering. A loss ratio of 60-70 is believed to be in the safe zone.

In the chart above, you can see that New Jersey insurance companies have a good handle on PIP, Med Pay and uninsured/underinsured motorist claims rates across the country.

We will cover the amount of losses for specific companies later. On balance, New Jersey insurers and policyholders appear to be making good choices given their choice. Making these choices keeps prices and insurance company profits from rising too fast. However, it could be worse.

Looking at loss rates in other no-fault states puts New Jersey’s high rates in perspective. New Jersey is one of 11 no-fault states in the US that actually offers options.

Things Standard Car Insurance Doesn’t Cover

Florida is another no-fault state with a high rate, but offers a minimum PIP option of $10,000. The chart below compares New Jersey to Florida and Michigan.

In 2015, Michigan auto insurers accounted for only 12 percent of all PIP claims in Florida; However, the insurance companies had to pay more than a billion in damages from auto insurance companies in Florida. New Jersey ranks second in the number of lawsuits filed and third in the amount spent on lawsuits. Florida requires a minimum PIP coverage of $10,000 and Michigan includes unlimited PIP coverage. Then again, it could get worse.

With 15 percent of New Jersey residents driving without insurance, that means only 85 percent are willing to pay higher premiums, even with a variety of options. Having so many options can be confusing and frustrating, so we believe these 868,000 or so drivers are enjoying the bliss of ignorance. But what about people who use their brains to commit insurance fraud? Not just policyholders, but doctors, lawyers and insurance agents can be involved in fraud. Listen to the following case involving several people working together to get a car insurance claim.

The New Jersey Attorney General’s Office of Insurance Prosecution handles all auto insurance fraud reports and cases. And NJ does not take fraud lightly. In fact, in 2013, the National Audit Office launched a public awareness campaign

Nj Gov Signs Car Insurance Law To Raise Minimum Liability Limits, Will Impact 1.1 Million Drivers

Aaa car insurance nj, car insurance rates nj, nj car insurance companies, car insurance quote nj, commercial car insurance nj, compare car insurance nj, historic car insurance nj, lowest car insurance in nj, car insurance quotes nj compare, best car insurance nj, car insurance trenton nj, car insurance quotes nj