Insurance Rates – “When an insurance company adjusts its rates for a certain coverage, it means that the cost to the company to cover that coverage has changed.” Financial Services Commission of Ontario

When your premiums go up even though your situation doesn’t seem to have changed, you may feel frustrated and wonder why? With that in mind, we hope to provide some insight into what is going on behind the scenes that is contributing to the rise in rates across the industry.

Contents

- Insurance Rates

- The Impact Of Natural Disasters On Insurance Rates In 2023

- Why Do Car And Home Insurance Rates Increase

- Car Insurance Industry Statistics In 2023

- Life Insurance Prices By Age In India 2023

- Why Are Directors & Officer’s Insurance Rates Rising?

- Solved: Calculating Uk National Insurance Rates

- Do Home Title Insurance Rates Increase Over Time?

- Factors That Affect Car Insurance Rates (2023)

- How Are Vehicle Insurance Rates Calculated

- Gallery for Insurance Rates

- Related posts:

Insurance Rates

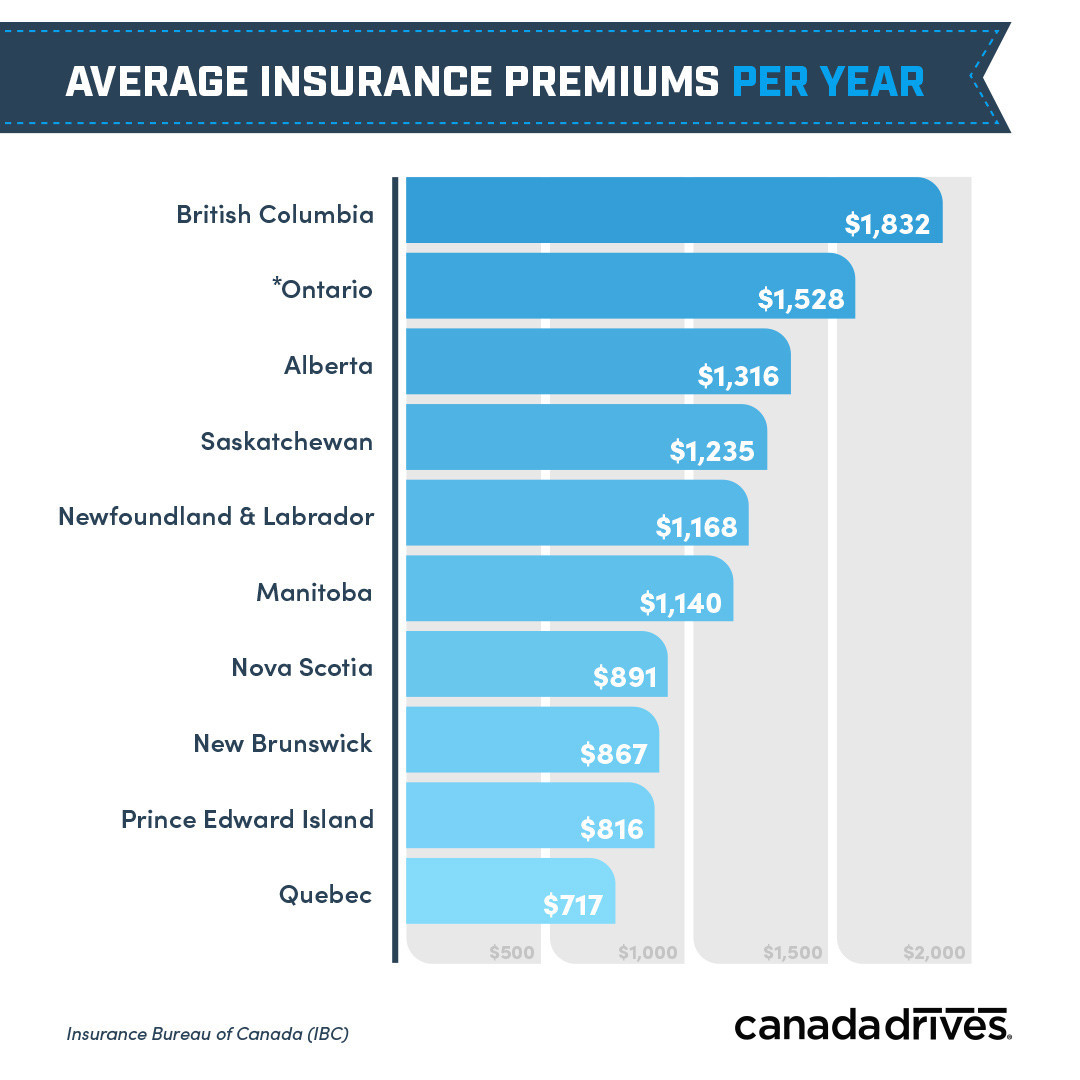

Before listing the common factors that drive up car insurance rates, it’s worth noting that car insurance premiums in Ontario are regulated by the government.

The Impact Of Natural Disasters On Insurance Rates In 2023

In order to implement a rate change, insurers must first submit all of their rate change proposals to the Financial Services Commission of Ontario (FSCO) with supporting actuarial data for approval.

FSCO and its actuaries then review this data and insurers’ assumptions about claims costs, expenses and investment income to ensure that the rates offered are in accordance with the law:

As a result of the FSCO review, the insurance company may be required to change its proposed rates before they are approved. The interest rate can only be increased after FSCO approves the application.

Windscreens now have built-in technology – new advanced driver assistance systems make it more expensive to replace windscreens. Recalibrating the car’s computer system after a windshield replacement also adds to labor costs.

Why Do Car And Home Insurance Rates Increase

Front and rear bumper sensors are expensive – even a small fender bender can require a bumper replacement. Many repairs also require the vehicle’s computer system to be recalibrated in order for the sensors to work. Additional labor costs can really add up.

State-of-the-art autonomous features – Newer vehicles can now have a whole host of autonomous features, such as adaptive cruise control and park assist. As you might expect, they also use complex computer systems and sensors that cost more to repair.

A-fault collisions, traffic tickets or violations, and license suspensions – If you have an accident where you are at fault, you are more at risk of insuring (plus, you may lose your no-claims discount if you have one). Traffic tickets or violations and having your driver’s license suspended (if not for administrative or medical reasons) also increase your risk level, often resulting in higher premiums.

Fraudulent Claims – Fraudsters who stage accidents to make money affect the entire industry. The Insurance Bureau of Canada reports that in Ontario alone, auto insurance fraud costs drivers an estimated $1.6 billion each year (or about $236 per driver). Prices rise to cover these costs.

Car Insurance Industry Statistics In 2023

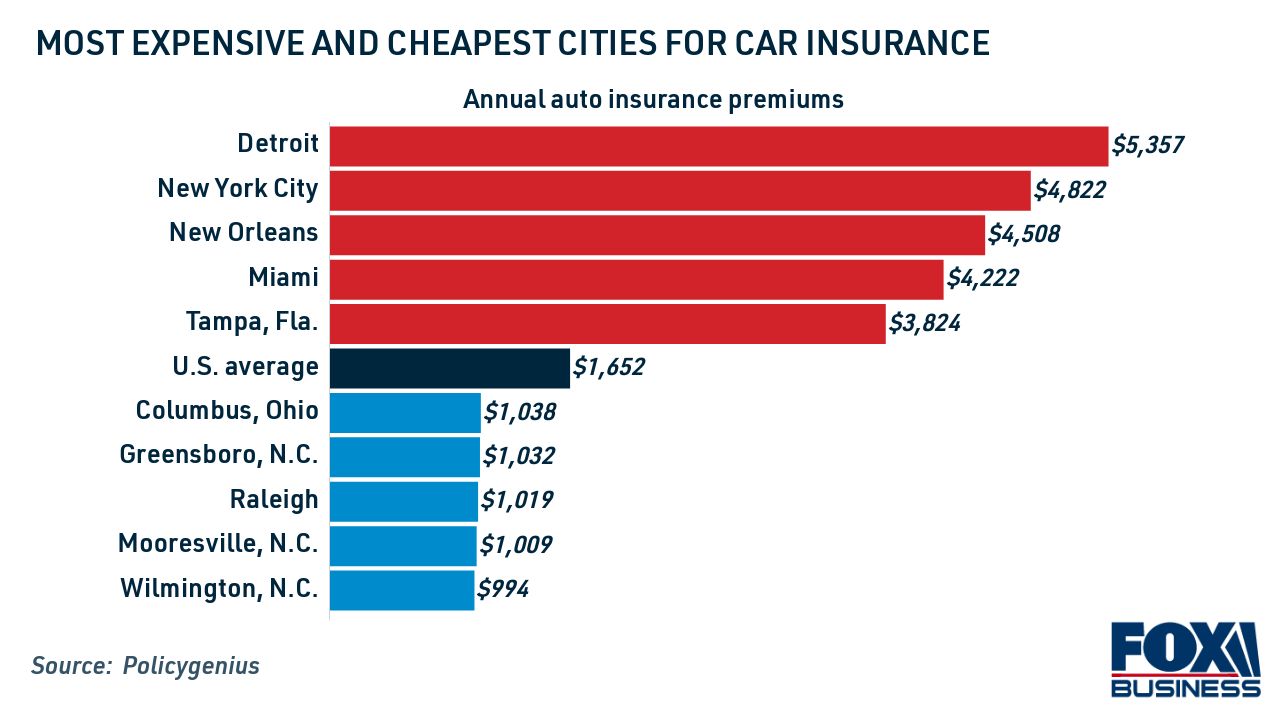

Distracted Driving – Distracted driving now surpasses drinking as the leading cause of accidents and deaths, and the damages involved in distracted driving accidents tend to be more severe. Premiums often increase to offset these costs.

Medical services are more expensive – it’s not just physical repairs that can increase premiums. If you have been injured in an accident, you may need medical services, such as physical therapy, to help you recover. And like everything else these days, these services cost more every year.

Trends that indicate your area is at higher risk of collisions, thefts or other incidents – Your premiums may increase if the analysis shows that your area has changed risks (such as additional traffic congestion or extreme weather events that lead to collisions, for example).

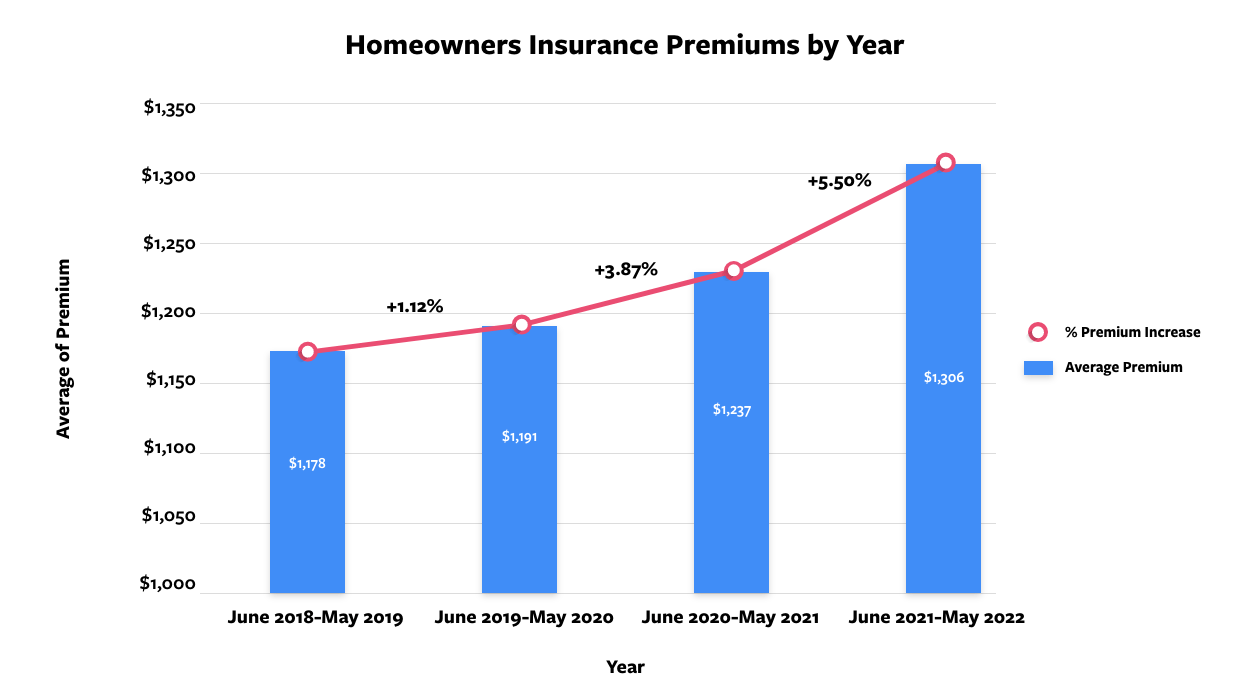

Modern Homes and Real Estate Prices – Rising home prices and more homes with high-end features like pools and hot tubs have increased replacement costs and liability claims.

Life Insurance Prices By Age In India 2023

Finished basements with electronics – Thanks to more expensive building materials, finished basements take more time to repair than there is sewer backup or other damage. Additionally, finished basements are more likely to contain expensive valuables such as electronics and furniture.

Eco-friendly but not budget-friendly – Newer homes with eco-friendly features like solar panels, energy-efficient windows and doors, and efficient appliances are more expensive to repair or replace.

Aging Municipal Infrastructure – Aging municipal infrastructure and increased demand for water make sewer backups more common, resulting in more damage claims.

Your claims history has changed – if you need to make a claim, you may lose the claim-free status discount. Submitting MULTIPLE claims may also result in an additional charge.

Why Are Directors & Officer’s Insurance Rates Rising?

Neighborhood trends put you at greater risk – As neighborhoods grow, it changes demographics and risks. Perhaps a new bar has increased the potential for crime, or a new subdivision has changed the city’s infrastructure, which are some of the factors insurers look at when assessing risk.

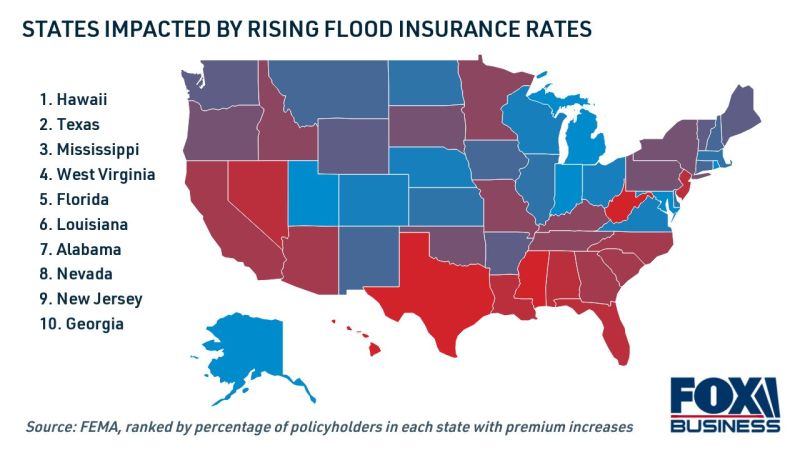

Extreme weather events and disasters are more frequent – wildfires, floods, storms and other events are increasing in frequency and causing costly losses, resulting in more claims and higher insurance costs.

Emergency services, skilled labor and personal property are more expensive – As with any good or service, inflation means higher prices for things like emergency services and labor costs for repairs. This means that paying claims is also more expensive.

Interest – In order to achieve profitable results, insurers often offset insurance losses with investment income. When interest rates are relatively low (as they have been), investment income falls, which in turn puts pressure on interest rates to make a profit.

Solved: Calculating Uk National Insurance Rates

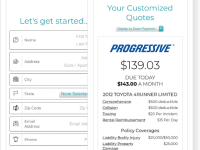

At CMR, we have access to a wide selection of the nation’s top insurers, most of which do not sell directly to the public. With this in mind, it is important to remember that we work for you, our client, not the insurance companies we represent. Simply put, we put your best interests first.

As your broker, it is our job to provide you with expert and unbiased advice. When it comes to insurance, we are always available to discuss your individual needs and recommend options based on your specific situation. Although we do not control the prices paid by insurance companies or general market conditions, we can regularly check to ensure that we get the best deal for you from our portfolio of offers.

If you have any questions or concerns about insurance or are interested in your options, please contact CMR and we will be happy to help. While we can’t find a market that offers a better rate than what you’re currently paying, we can provide unbiased advice on how to tailor your policy (taking into account your budget and risk tolerance) to better suit your individual needs.

November 17, 2023 Water is the new fire As climate change affects flooding, Canada’s vulnerability may become uninsurable. But with adequate adaptation methods, experts hope that…

Do Home Title Insurance Rates Increase Over Time?

Oct 9, 2023 Why You May Need Personal Umbrella Insurance What is Umbrella Insurance? A personal umbrella policy protects you in the event that litigation costs are higher…Life insurance offers protection against death on the one hand and saves for old age on the other.

Due to the low interest rates, this type of insurance is no longer recommended today. Term life insurance can be concluded as death protection. There are much better options for nursing homes.

Old contracts can still be pretty good. If you already have whole life insurance, don’t cancel it quickly, but consider selling it instead.

In short: No one will need whole life insurance in 2022. We recommend that the new policy does this. Why do we say this?

Factors That Affect Car Insurance Rates (2023)

Traditional life insurance always includes death insurance – so the family gets money if the insured person dies before the due date. At the same time, insurance should also take care of old age. The goal is to save money that can be paid out as an annuity or lump sum when you retire. The combination of two objectives (funeral benefit and savings plan) in a life insurance policy leads to two significant disadvantages.

First, a separate life insurance policy for death benefits gives you much more flexibility. Second, interest is not calculated on the total premium paid, but only on the savings after deducting the death benefit premium.

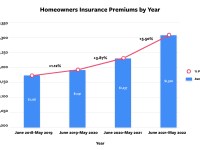

20 years ago, the guaranteed interest rate on traditional life insurance was over 3.5%. For policies taken out starting in 2022, the legislator lowered the maximum guaranteed interest rate to 0.25%. The following graph shows the increasing decline in the guaranteed interest rate:

A guaranteed interest rate used to be a selling point for development life insurance. When concluding the contract, the insurer could be sure that at least this interest rate can be expected until the end of the contract. However, the current low interest rate environment means that insurance companies can no longer make enough profit to warrant higher interest rates. For this reason, the legislature regularly humiliated them.

How Are Vehicle Insurance Rates Calculated

The insurance industry has been calling for the rate to be lowered again to 0.25% from 2019, as it reduces the guaranteed pensions that insurers have to promise their customers at the end of the contract period. At the same time, the low interest rate makes life insurance unattractive as a retirement capital accumulation model. There are many other ways to secure your retirement that promise significantly better returns.

Acquisition cost of endowment life insurance

Term.life insurance rates, lowest rates auto insurance, best boat insurance rates, best motorcycle insurance rates, life insurance rates quotes, best life insurance rates, car insurance lowest rates, aarp life insurance rates, life insurance rates, average rv insurance rates, best insurance rates, workers compensation insurance rates