Online Health Insurance – 6 Reasons to Buy Health Insurance Online Finding a Life Partner Buying a Movie Ticket Our generation does a lot of things online. This saves time, energy and money. Here are the main advantages of buying health insurance online. 1 You become your own judge of online shopping preferences. You can find the best plan based on your needs without the intervention of any agent or other seller. 2 No unfinished form Buying online can help you avoid lengthy forms required to buy insurance offline. The steps involved in purchasing a policy are reduced as there are no intermediaries such as instant policy agents or insurance companies. This saves a lot of time. 4 Pro Tips Pro Tips Things to Choose When Buying Health Insurance Online You can ask for help at any stage. Compare, choose, buy, pay and check out in 5 simple steps. Follow these steps and you will receive your policy in 10 minutes. 6 Easy Payments Paying for a policy is as easy as anything you buy online. You don’t have to worry about carrying heavy cash.

“Health insurance, also known as mediclaim insurance, is an insurance plan that covers hospitalization expenses and related expenses. Know more reasons to buy health insurance online”

Contents

- Online Health Insurance

- Infografik Der Krankenversicherung Ärztliche Untersuchung Gesundheitsschutz Gesundheitswesen Medizinischer Dienst Onlinearztdiagnose Vektorillustration Stock Vektor Art Und Mehr Bilder Von Allgemeinarztpraxis

- Essential Health Insurance

- Health Insurance Claim Form With Medicine And Money On Laptop Computer In Flat Design. Online Medical Insurance Service Concept. Stock Vektorgrafik

- Online Sales Of Health Insurance Increasing Rapidly

- Choose The Best Health Plan With A Premium Calculator| Kotak General Insurance

- Gallery for Online Health Insurance

- Related posts:

Online Health Insurance

Obamacare, Harvard Group Research Results Millions Gain Health Insurance – Your Health Insurance Against Fraud Services Tokyo Digitization is making its mark in every sector globally. Every aspect of your life is trying to build and engage with their audience through a digital presence. From education to banks and even your groceries are just a click away. If the world is embracing this digitalization wave, why should the insurance market lag behind?

Infografik Der Krankenversicherung Ärztliche Untersuchung Gesundheitsschutz Gesundheitswesen Medizinischer Dienst Onlinearztdiagnose Vektorillustration Stock Vektor Art Und Mehr Bilder Von Allgemeinarztpraxis

77% of medium-sized business owners believe that a digital presence helps them acquire customers. Digitization is nothing less than the modern industrial revolution. Digitization with the help of knowledge automation has increased the productivity of technicians by 45-50%. Of late, the insurance industry has been greatly affected by the penetration of digitization, making it easier to find and invest in your future by looking for simple ways to benefit from insurance.

Medical insurance has become a necessity in today’s era when the costs of medical facilities are skyrocketing. Six years ago, getting health insurance was a daunting task. There were many middlemen involved, each with a different story to tell you. Weighing all the options, doing the endless paperwork, and finally getting the health insurance you want is nothing short of a world-beating feat.

Following an agent-centric model, insurance companies today are undergoing digital transformation to improve the end-to-end customer experience. The insurance industry is moving forward and consumers are not very happy with insurance companies riding on digitalization.

Digitization enables insurers to expand and use low-cost digital distribution channels for sales and services, ultimately shaping their market position. The growth of the digital age in the insurance industry has many benefits besides increasing productivity and speed. Some of them are as follows:

Essential Health Insurance

For a little insight into the daunting task of buying insurance, ask someone who grew up in the pre-Internet era. They will tell you about getting insurance through their agents. Door-to-door salesmen were not reliable, so they used a family friend or connection. Now, even the idea of exploring the many health insurance policies that sell them seems foreign and uncomfortable.

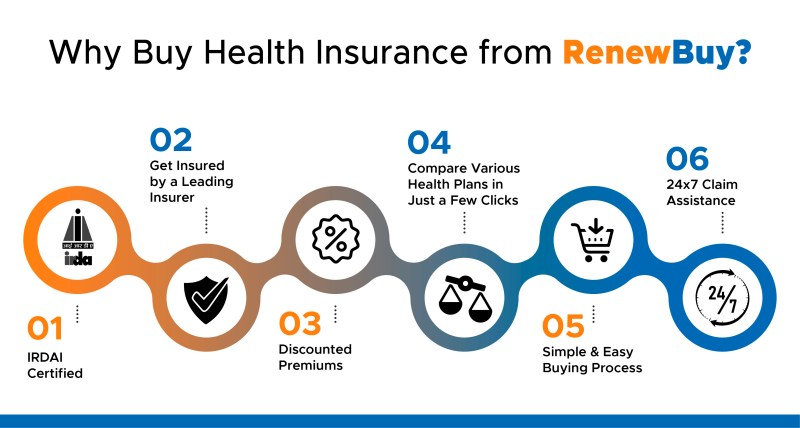

As insurers go digital with their services, there is less agent intervention. Today, all the popular insurance companies have made arrangements online so that you can find the policy that suits you best. Many insurance aggregators list complete plans for each health insurance policy. You can avail the plan of your choice by filling a simple online proposal form and paying the premium amount. The information is fed directly into the insurer’s database without an intermediary. As a result of digitization, insurers save on agent fees, resulting in lower premiums for you.

By eliminating middlemen, customers do not have to leave their routine to check the presence of agents who disrupt their schedule. Chatbots are available 24/7 accurately and faster compared to a human service manager. By combining artificial intelligence with machine learning and analytics, chatbots are designed to interact with customers, solve their queries and answer their queries. In addition, chatbots are very useful because they make better recommendations tailored to the user they interact with.

Digitization of human communication has made the process of getting health insurance hassle free and fast. Aviva has digitized its health insurance plans, making it easy to invest quickly online, meaning your healthcare is just a few clicks away!

Health Insurance Claim Form With Medicine And Money On Laptop Computer In Flat Design. Online Medical Insurance Service Concept. Stock Vektorgrafik

Nothing causes consumers to lose trust in insurers faster than being mis-sold insurance products. Weak faith is not only bad for business, but the insurer can be heavy on the pocket if proven to have mis-sold the product to its customers.

Digitization has reduced the chances of such incidents, making it a better experience for both the insurer and the customer. Apart from that, digital usage has put companies on a pedestal where they can be criticized and judged. Looking at customer reviews of health insurance providers will give you a better idea of the service you are signing up for. With social media, you always have the opportunity to talk to an expert and get an unbiased opinion to better understand the type of product that best suits your needs.

Digitization gives insurers access to critical data and vast information about your life. All this data is a true reflection of what type of insurance is best for you. Your lifestyle is helpful when buying a new policy or renewing an existing policy. Here’s an example of how it works – with smart watches and mobiles, health insurers can capture important metrics of your daily activities and pinpoint areas that need attention.

After that, you will get the statistics of the vial about your health and, if necessary, take corrective measures. Additionally, you may be rewarded for being healthy and responsible when it comes to lifestyle in the form of lower premiums or higher insurance coverage.

Online Sales Of Health Insurance Increasing Rapidly

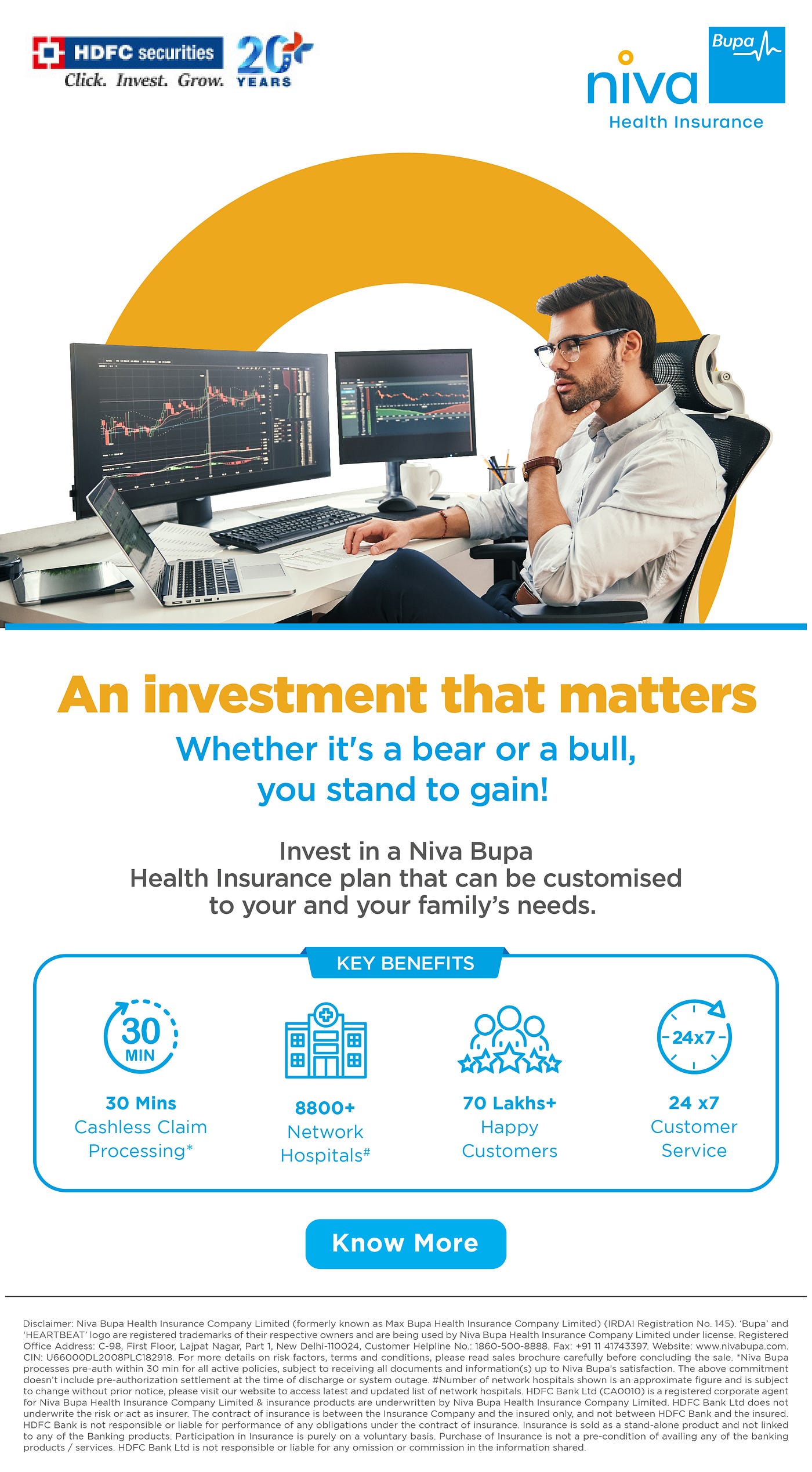

Digital data exchange on cloud-based platforms accelerates claims processing and settlements. When you initiate a digital claim, you can fill the claim settlement form online, attach the relevant document(s) and send it to your insurer in seconds. In case of an unplanned hospitalization, the digital way allows you to quickly resolve your health insurance claims. Digitization has proven to be a game changer for the insurance industry and their customers. According to a study conducted by Business Today, by 2020 digital insurance will grow 2,000 percent from where it is today.

We are truly on the path to a large digital ecosystem and Aviva believes in being ‘Digital First’ with a wide range of insurance solutions available to customers online. In an ever-evolving online world, we’re here to reinvent and innovate! With medical treatment becoming more expensive every year, health insurance has become a necessity rather than a luxury. Apart from allowing people to get proper medical care during hospitalization, health insurance has other benefits. These benefits of buying health insurance online include coverage for hospital stay (home treatment if doctor allows), top-up, personal assistance and cashless facility. Features and benefits vary from insurer to insurer and depend on the premiums paid by the user. Let’s find out if it is safe to buy health insurance online.

As the online world is becoming a part of our lives, many people prefer to buy health insurance plans online. Almost all leading insurance companies offer secure online transactions.

As there are many advantages of buying health insurance online, it is becoming a preferred mode for most of the people. Some of the key benefits are:

Choose The Best Health Plan With A Premium Calculator| Kotak General Insurance

The first advantage is to compare policies of all health insurance companies by clicking a few buttons. A person does not need to contact agents of different companies or visit their offices for information. Many third-party websites also help individuals compare features, premiums and insurance coverage of different companies. This saves a lot of energy and time, otherwise wasted in conducting research.

The policy terms and conditions of reputed companies are available in detail. Many websites

Renew health insurance online, get health insurance online, buy health insurance online, online health insurance marketplace, cheap online health insurance, online health insurance plans, health insurance certification online, online health insurance quotes, shop health insurance online, health insurance apply online, health insurance courses online, health insurance online