Product Liability Insurance – In a world where product litigation is on the rise, businesses must be well prepared to protect themselves from potential liabilities.

This article discusses the details of product liability insurance, why it is essential for companies, and how to choose the right coverage.

Contents

- Product Liability Insurance

- The Importance Of Product Liability Insurance For Your Commercial Coverage

- Are Amz 3p Sellers Safe Without Product Liability Insurance?

- Public And Product Liability Insurance For Businesses In Au

- Public & Product Liability Insurance

- What Is The Cost Of Product Liability Insurance Policy?

- Is Medical Product Liability Insurance Right For Your Clients? « Access E&s Insurance Services

- Does General Liability Include Product Recall Insurance?

- What You Should Know About Product Liability Insurance By Crystal Cane

- Gallery for Product Liability Insurance

- Related posts:

Product Liability Insurance

Product liability insurance is a type of coverage that protects businesses from financial losses related to legal claims against them due to injuries or damages caused by their products.

The Importance Of Product Liability Insurance For Your Commercial Coverage

This type of insurance covers claims arising out of incidents occurring during the policy term, regardless of when the claim is filed.

Comprehensive cover sets the maximum limit for claims within the policy term. Once this limit is reached, the policy will not cover further claims.

Larger businesses with broader product lines may pay higher premiums due to increased exposure to potential claims.

Businesses should notify their insurer to begin the claims process as soon as a potential liability issue arises.

Are Amz 3p Sellers Safe Without Product Liability Insurance?

Choosing the right coverage and understanding the key factors that affect premiums are essential to protecting your business product liabilities.

Product liability insurance requirements vary by jurisdiction. It is important to check your local regulations to determine if this is mandatory for your business.

Evaluate your business’s product line and potential risks. Consulting with an insurance professional can help you determine the right coverage.

No, product liability insurance is a subset of general liability insurance. While general liability insurance covers many business-related liabilities, product liability insurance focuses on product-related claims.

Public And Product Liability Insurance For Businesses In Au

Product liability insurance typically covers damages such as bodily injury, property damage, medical expenses, legal fees, and settlements resulting from a product-related claim.

Yes, businesses that sell products under their brand name can be held liable for product defects, even if they did not manufacture the product. This is known as “brand liability” and product liability insurance can protect you in such cases.

The statute of limitations for product liability claims varies by jurisdiction. It is important to understand the time frame within which a claim must be filed to ensure eligibility for coverage. Liability insurance is an insurance product that provides protection against claims arising from injury and damage to other people or property. A liability insurance policy covers any legal costs and payments that the insured is liable for if found to be legally liable. Intentional damages and contractual obligations are usually not covered by liability insurance policies.

Liability insurance is crucial for those who are responsible and liable for injuries caused by other people or if the insured damages someone else’s property. That is why liability insurance is also called third party insurance. Liability insurance does not cover intentional or tortious acts even if the insured is found legally responsible. Anyone who owns a business, drives a car, practices medicine or is a lawyer takes out a policy – basically anyone who can sue for damages and/or injuries. Insurance policies protect both the insured and third parties who may be harmed by the insured’s inadvertent negligence.

Public & Product Liability Insurance

For example, most states require car owners to have liability insurance as part of their auto insurance policy to cover damage to other people and property in the event of an accident. Product manufacturers can purchase product liability insurance to cover them if the product is defective and causes harm to buyers or other third parties. Business owners can purchase liability insurance that covers them if an employee is injured during business operations. Decisions that doctors and surgeons make while on the job also require liability insurance policies.

Personal liability insurance policies are generally purchased by high net worth individuals (HNWI) or those with large assets, but this type of coverage is recommended for those whose net worth exceeds the combined coverage limits of other individual insurance policies, such as home and auto coverage. The cost of an additional insurance policy is not attractive to everyone, however, most carriers offer discounted rates for bundled coverage packages. Personal liability insurance is considered a secondary policy and may require the insured to carry certain limits on home and auto policies, which may result in additional costs.

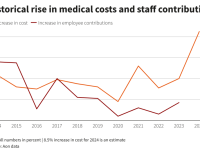

The global liability insurance market size was estimated at more than USD 25 billion in 2021 and is expected to reach USD 433 billion by 2031.

While general commercial liability insurance protects against most legal problems, it does not protect directors and officers from lawsuits, and it does not protect the insured from errors or omissions. Companies need specific policies for these situations, such as:

What Is The Cost Of Product Liability Insurance Policy?

Business owners are subject to a number of liabilities, any of which can subject their assets to significant claims. Every business owner should have an asset protection plan based on affordable liability insurance coverage.

Personal liability insurance covers individuals against claims arising from injuries or damage to other people or property suffered on the insured’s property or as a result of the insured’s actions. In contrast, business liability insurance protects the financial interests of companies and business owners from lawsuits or damages arising from similar accidents, but also covers product defects, recalls, etc.

An umbrella policy is additional liability insurance coverage purchased over and above the insured’s existing homeowners, auto or boat insurance. Umbrella policies are typically available and offered for $500,000 or $1 million in excess.

Generally, you must have liability coverage when the event that gives rise to the claim occurs. However, retroactive liability insurance is insurance that provides coverage for a claim that occurred before the policy was purchased. This policy is unusual and usually only available to businesses.

Is Medical Product Liability Insurance Right For Your Clients? « Access E&s Insurance Services

Require authors to use primary sources to support their work. These include white papers, government data, original reports and interviews with industry experts. We also cite original research from other reputable publishers where appropriate. You can learn more about our standards for producing accurate, unbiased content in our Editorial Policy.

The offers shown in this table are from the partnerships he receives compensation from. This offset may affect how and where the listing appears. Does not include all offers on the market.

By clicking “Accept all cookies” you consent to the storage of cookies on your device to improve website navigation, analyze website usage and assist our marketing efforts. Either way, you definitely know how the insurance industry helps businesses reduce risk. Insurance acts as a safety net that protects the insured against various potential risks. There are many insurance policies that are offered based on the unique needs and requirements of the customer. Here we discuss product liability insurance and how it differs from general liability insurance

Product liability insurance protects your business from claims or lawsuits arising from personal injury or property damage caused by defective items manufactured, distributed or sold by your business. Product liability insurance is comparable in many ways to general liability insurance. A general liability insurance policy usually includes some product liability coverage. However, higher risk businesses may need to increase their limits or obtain additional coverage. Product liability insurance can be considered a unique type of insurance designed exclusively for businesses that manufacture and sell products.

Does General Liability Include Product Recall Insurance?

A product can be almost any type of good that is sold to consumers or businesses, from food and clothing to specialty items such as cars and medicines. For example, food served in a restaurant can make someone sick. A small toy that is not properly labeled can be a choking hazard. A computer purchased online can overheat and harm the user. A lawnmower that has just been repaired in a shop can malfunction and injure the user.

Anyone who comes into contact with your product, including buyers, customers, or even visitors, can be considered an affected third party.

A good product liability insurance policy should cover a wide range of costs associated with product-related claims, such as the cost of disposing of defective products, the cost of replacing defective products, business interruption, and fees that wholesalers or retailers may incur. It must also cover the costs of public relations initiatives aimed at repairing reputational damage caused by allegations about the product.

General liability insurance, on the other hand, is a type of insurance that provides business protection against a wide range of claims, including personal injury, property damage, personal injury (such as defamation or false advertising), and more. Facial injury. It is designed to protect businesses from the financial costs associated with defending against these types of claims and any settlements or judgments.

What You Should Know About Product Liability Insurance By Crystal Cane

Imagine that a customer visits a restaurant and slips on a wet floor, resulting in a serious injury. The customer decides to sue the restaurant for damages, alleging that the restaurant was negligent in maintaining a safe environment. If the restaurant has general liability insurance, the policy will cover the costs of defending against a lawsuit, including legal fees and any settlements or judgments that may be entered.

In each of these cases, general liability insurance provides financial protection for the business against the costs of defending against a lawsuit and any

Product liability insurance for food, what is product liability insurance, small business product liability insurance, general product liability insurance, product insurance liability, amazon product liability insurance, farm product liability insurance, cosmetic product liability insurance, product liability insurance companies, food product liability insurance, product liability insurance cost, product liability insurance quote