Progressive Car Insurance Online Quote – Buyers, lenders and insurance companies often talk about liability and physical coverage (total and collision) when describing auto insurance. However, there is no consensus on what constitutes “comprehensive car insurance”. Make no mistake – no insurance company will buy you a policy that will cover you 100% under any circumstances.

When financing or leasing a vehicle, your lender may use the term “full coverage.” This means you need comprehensive, collision insurance, and anything else your state requires. Liability insurance is mandatory in almost all states, but comprehensive and collision (body protection) are optional. However, lenders may set their own rules for required insurance. Find out more about state car insurance requirements and obligations, as well as complete car insurance coverage.

Contents

- Progressive Car Insurance Online Quote

- Progressive Adding Family Members Without Notice

- Car Insurance Coverage For Spouses

- Exploring Progressive’s Autoquote Explorer

- Kiplinger Readers’ Choice Awards: Auto Insurance Companies

- Home & Auto Insurance Bundle

- Usage Based Car Insurance

- Best Car Insurance For Instacart Drivers In 2024 (top 10 Companies)

- Best Auto Insurance Companies That Don’t Ask For Your Ssn (2024)

- Do I Have To Change My Car Insurance When Moving?

- Related posts:

Progressive Car Insurance Online Quote

“Is my car still covered by insurance?” Instead of asking, ask your insurance company or dealer if they have the right price. Paying for all the coverage offered by an insurance company can be expensive. Even if your lender believes the government liability is sufficient, it may not be enough to cover you or the other drivers on your policy. You may want to consider making additional arrangements for yourself, your family, and your vehicle.

Progressive Adding Family Members Without Notice

No policy can protect you 100 percent in all situations, but there are coverage options that can help you better protect yourself and your vehicle. Let’s break it down.

Often, insurance companies, dealers or lenders will refer to comprehensive car insurance, which means comprehensive and collision coverage, as well as other coverage required by your state.

For example, liability insurance is mandatory in almost every state. Insures against injury or damage to the vehicle or other persons up to a certain limit.

This is optional if not required by your lender or leasing company. They can pay for damage to your car caused by events that are within or outside of your control. And the price?

Car Insurance Coverage For Spouses

A liability only policy is much cheaper than a comprehensive and conflicting policy.

The deals you choose and the prices you can set will all find the right price for you.

Let’s discuss which coverage is best for you! We offer insurance over the phone, online and through independent agents. Prices vary depending on your purchase.

Even if your lender won’t cover it, a new car and its maintenance are still important. Comprehensive and collision coverage pays for damage to your vehicle from accidents or incidents that are within your control or beyond your control. If your car is worth less, it may not make sense to get accident insurance. Be aware that if you decide to get liability only coverage, you may be able to buy a new car without full coverage or without coverage.

Exploring Progressive’s Autoquote Explorer

Additional services such as roadside assistance or car rental are inexpensive and can be purchased at your discretion.

Example: There is an accident and your car is worth $15,000. Your liability will pay for the damage to the other driver’s car, but your collision company will pay $15,000 (less your deductible) to help replace your car. Without collision coverage, you will have to pay out of pocket to buy a new car.

You can access your policy using the insurance company’s mobile app or online account portal and check your vehicle’s coverage details to find a complete list of coverages. Your full coverage may be listed in the summary section of your policy statement page. If you look under your vehicle for collision and comprehensive coverage (sometimes called “non-collision”), you’ll be covered against bodily harm.

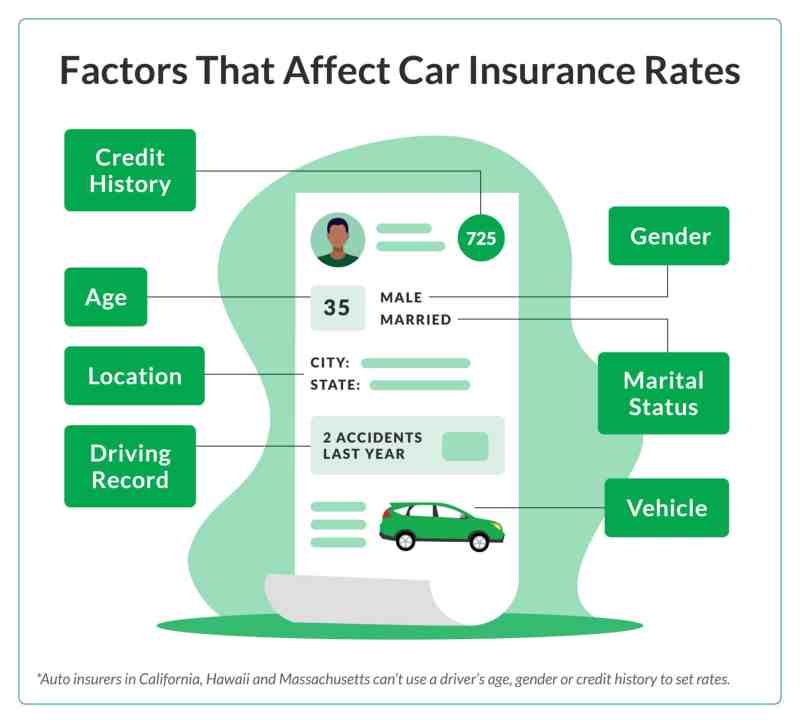

Bodily injury coverage and other additional coverages can be more expensive than a liability-only policy. How much depends on many factors, including the year, make and model of the vehicle you want to insure, and the auto insurance discount you choose — comprehensive and collision insurance costs less if you choose a higher deductible.

Kiplinger Readers’ Choice Awards: Auto Insurance Companies

There are many car insurance quotes that can help you get cheap and affordable car insurance, so keep in mind that policies and insurance may cost more than you think.

Here is a summary of the car insurance coverage available from most insurance companies. Please note that our “full coverage” policies are not guaranteed. See our car insurance policies for details.

What’s covered: If you’re at fault in an accident, you’ll pay legal fees for damages or injuries you cause to others, and up to your policy limits if someone sues you.

Uninsured motorist coverage will pay for damages and injuries to your vehicle, up to certain limits, for example, if you’re uninsured or underinsured.

Home & Auto Insurance Bundle

Insurance Regardless of fault, health insurance can cover medical bills and funeral expenses in the event of an accident. This protection applies to your family members and passengers. In some states, personal injury insurance covers medical expenses and self-protection.

What’s covered If your car is damaged or destroyed for reasons beyond your control (theft, theft, fire, broken glass, animal attacks, weather problems), comprehensive insurance can pay to repair or replace your vehicle.

Coverage: Collision coverage pays to repair or replace your vehicle and can cover your deductible if your vehicle is at fault for hitting a car, motorcycle, tree, obstacle, or other object.

Gap insurance can cover the difference between your car loan and the total value of the car. offers similar protection called loan/lease protection.

Usage Based Car Insurance

What’s covered If you’re in an accident and you’re unable to drive your vehicle, rental car insurance can cover the cost of your vehicle while it’s being repaired.

Coverage: If your vehicle breaks down, roadside assistance can tow your vehicle to the nearest repair facility. Depending on the insurance company, roadside assistance can include battery charging, winches, air conditioning, locksmith services, tire changes, and more. Learn how roadside assistance can help you on the road.

Call 1-866-749-7436 or get a car insurance quote online. We can help you create policies that provide the right protection.

Log in to your policy or call us at 1-866-749-7436 to make sure your coverage is current and you’re happy with it. Want to know how to insure your new car? The reality is that your current insurance policy will cover your new car as soon as you drive it, meaning it has the same level of protection as your old car. But if you don’t have liability or personal injury protection, you could be arrested as a trafficker or worse, breaking the law.

Best Car Insurance For Instacart Drivers In 2024 (top 10 Companies)

Watch our short video to learn all about insuring your new car, from adding a policy to choosing the right coverage.

When you buy a new car, your used car insurance will cover your new car for a very short period of time. It takes approximately 7-30 days to officially add your car to your policy.

Most governments want accountability. It protects you if you are responsible for an accident that injures someone else or damages someone else’s car or property.

If you have a loan or lease, you may have to pay the rent. This can help cover the difference if your new car is stolen or your loan is over the limit.

Best Auto Insurance Companies That Don’t Ask For Your Ssn (2024)

Unpaid debt, $25,000, no insurance, $20,000, except towing. Contact us today to insure your new car.

When you’re ready to buy a new car, contact us to add your new car or get a quote.

The cost of buying a new car usually goes up because the price is more expensive than your used car. If you start a new car insurance policy, remember that other factors can affect your car insurance rates. Even though your rates have gone up, you may still be able to afford your car insurance premiums.

Required Insurance: Comprehensive auto insurance and collision coverage are often mandated by the lender. If you are at fault in an accident, your local will want to pay for your injuries and damages.

Do I Have To Change My Car Insurance When Moving?

Other coverage options: You may be required to pay off the proposed loan/lease. Loan/lease payments can cover vehicle payments and up to 25 percent of the actual cash value of your vehicle if it’s stolen or stolen, although limits may vary by state. You may need to enter the owner’s name and address within 2-3 days of purchasing a policy or adding a new car to an existing policy. Please note that equivalent coverage and difference coverage may be available from dealers or other insurance companies.

Required Coverage: Rental companies often require comprehensive and collision coverage, and may or may not

Progressive car insurance quote comparison, progressive free quote car insurance, online car insurance quote progressive, progressive insurance quote online, progressive car insurance quote florida, progressive home insurance quote online, progressive quote for car insurance, progressive auto insurance online quote, progressive car insurance quote number, progressive new car insurance quote, progressive car insurance retrieve quote, progressive car insurance quote