Progressive Get A Free Quote – Business insurance protects your small business against financial losses due to accidents, property damage, professional malpractice, workers’ compensation claims, and other situations. Having the right cover is essential to minimize the negative effects of claims on your business.

From basic coverage to specialty coverage, the Progressive Advantage® Business Program offers a wide range of business insurance, so you can get the best coverage for every stage of your business.

Contents

- Progressive Get A Free Quote

- Commercial Auto Insurance

- Multi State Car Insurance: Out Of State Coverage

- Progressive.com Auto Insurance Website Stock Photo

- Instantly Compare Car Insurance Quotes (2024)

- Progressive’s Search Results Page

- What Is Rideshare Insurance?

- Best Delivery Driver Insurance Of 2024

- Progressive Car Insurance Review 2024

- Progressive Insurance Review (2024)

- Compare Home & Auto Insurance Quotes

- How Much Does Insurance Go Up After An Accident?

- Jamie Dimon Quote: “i’ve Been Regulated My Whole Life. We Have Progressive Taxes. It’s Not A Free Market Free For All. I Completely Understa…”

- Related posts:

Progressive Get A Free Quote

Most small businesses need this protection. It protects against third party claims arising from your business activities. People sometimes refer to this coverage as “business insurance.”

Commercial Auto Insurance

You need this cover if you use your vehicles for business, such as visiting workplaces or delivering goods. It provides liability and bodily injury coverage for your commercial vehicles.

This process protects you and your employees. It helps cover costs such as medical expenses and lost wages related to workers who were injured or sick on the job.

Professional liability cover protects businesses that provide professional services or advice against professional negligence claims. It is also known as Errors and Omissions (E&O) Insurance.

This process combines commercial liability and asset protection into one approach. It is a popular choice for small businesses with commercial premises or personal property.

Multi State Car Insurance: Out Of State Coverage

This protection protects against electronic threats such as hacking. Businesses that store or handle sensitive information such as credit card information should consider this insurance.

Commercial insurance from Progressive Commercial protects your small business against financial loss due to accidents, property damage, professional malpractice and other conditions.

Progressive Commercial has coverages available to keep your business safe, including general and professional liability, business owner’s policies, workers’ comp and more.

How much you get depends on various factors such as your industry and the type of work you do. By focusing on developing your policy from the start, we’ll help you find the best coverage options so you can be confident you’re getting the right insurance for the right situation for your business.

Progressive.com Auto Insurance Website Stock Photo

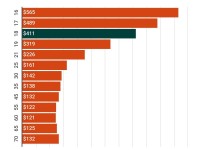

In 2022, the national cost of business insurance for new Progressive customers will range from $42 per month for a professional loan to $70 per month for a business owner policy (BOP).

Your costs will depend on a variety of factors, including the industry you’re in and the specific types of work you do. For example, one landscape company may only mow lawns, while another company offers additional services such as tree trimming. Both are landscapers, but their exposure to risk is different and reflected in their ratings.

Learn more about the factors that affect the cost of business insurance and what you can do to get the coverage you need at the best price.

We offer customized cover tailored to your business’s level of exposure to specific risks. The policy will tailor the deductibles you need to your specific needs with limits. Custom cover is flexible, so if your circumstances change – or you change your mind – you can always update your policy.

Instantly Compare Car Insurance Quotes (2024)

Beware of “one-size-fits-all” strategies. They may have gaps in coverage that leave you exposed. For example, you might think that general liability covers any business liability, but it doesn’t. Learn the difference between general liability and professional liability insurance.

We focus on booking your policy in advance to avoid these types of issues so you can be confident that you are getting the right insurance the first time.

From commercial property insurance to employee health care, we provide coverage for how you run your business. Customize your policy with quotes that suit you.

Liquor liability insurance is protection for businesses that manufacture, sell or serve alcoholic beverages. It is also known as dram shop insurance.

Progressive’s Search Results Page

Inland marine insurance covers movable property such as tools, equipment and other goods. It protects items stored while you are traveling across the country or away from your business.

Employment Practices Liability Insurance (EPLI) protects businesses against claims related to employee discrimination, sexual harassment, and wrongful termination.

Rideshare insurance is meant to bridge the gap between rideshare companies like Uber or Lyft that offer their own drivers and driver policies.

Commercial property insurance protects commercial buildings and movable property owned and operated by your business. It is provided as part of BOP.

A market for high-risk occupations that cannot afford normal credit protection in the approved market for overdue and overdue loans. It is also known as E&S insurance.

Health insurance is a benefit that allows your business to provide quality medical care to your employees and their dependents.

Business insurance describes personal coverage that can protect a small business. Your level of protection depends on the features you choose to carry.

For example, “business insurance” may refer to one type of cover, such as general liability, but may include many others, such as professional liability and workers’ compensation.

Best Delivery Driver Insurance Of 2024

The features you need will depend on your particular situation, but almost all businesses should consider general liability. This is the most general cover and protects against various claims related to third party injuries or property damage (eg slip and fall, broken windows).

In addition, you may need business car insurance if you or your employees drive for work-related activities. Many states also require you to collect workers’ compensation if you have employees.

Not sure what you want? Answer five simple questions to find out what issues you should consider for your small business.

Business insurance is essential to protect yourself against financial loss in the event of an accident. For example, say you are legally liable for a customer’s injury. Without insurance, it can be difficult to cover medical bills and legal fees. Business insurance can help prevent this type of loss.

Progressive Car Insurance Review 2024

It can be done. Depending on the particulars, in most cases general or professional liability applies. General liability protects against third-party injuries or damage to property, while professional liability focuses on negligence related to business services and advice.

Yes. Business insurance is important for owners because they are responsible for the liabilities of their business. In other words, their personal assets, such as bank accounts or real estate, are directed to satisfy the business debt. No matter how small your business is, you need to plan for potential financial losses.

Not all online businesses need business insurance, but many should consider coverage to protect themselves from liability. For example, cyber insurance covers businesses that handle customer payment information or store sensitive data from expenses in the event of a breach.

No. Homeowners insurance does not cover tools, equipment and materials used for business purposes. You can get coverage for these things through a business owners policy (BOP).

Progressive Insurance Review (2024)

Yes. Prepaid can help you find a variety of business insurance coverage, including general liability and professional liability, in every state except Hawaii. We also offer workers compensation and business owner policies in select areas. Search by country to see your options.

We want you to feel confident and secure with small business insurance. Here are some of the many reasons why you should choose us to help you find the best insurance for your business:

We help you maintain coverage at any stage of your business development and give you the flexibility to change coverage as your business grows. Our agents will work with you to ensure you get the coverage that fits your needs and budget.

We offer several ways to get custom business insurance. You can initiate a quote online, over the phone, or through a local agent. Updating your policy is easy and we usually process your application the same day you do.

Compare Home & Auto Insurance Quotes

, you can be sure that we will support you. Our specially trained in-house team will help you every step of the way to ensure you get the best protection for your business today and tomorrow, trucks and vans. Commercial vehicles require a special approach as they are more prone to accidents than personal vehicles.

Progressive offers unique benefits including flexible policies, competitive rates, discounts, special application services and more. Get a commercial auto insurance quote to get the best coverage for your business.

Commercial auto insurance from Progressive protects your commercial vehicles when they are used for work. They need their own policy because they are more often involved in accidents than their own vehicles.

Businesses such as contractors, landscapers and truck drivers often need a commercial vehicle policy. Businesses, such as shops and restaurants, that use vehicles or transport customers may also need auto insurance.

How Much Does Insurance Go Up After An Accident?

Many factors affect how much you pay for business auto insurance, including your occupation, coverage needs, vehicles and location.

But don’t worry. Progressive Commercial has options to lower your payments and protect your business, including primary liability, unpaid driver and more.

Commercial vehicle insurance is often required by businesses that use vehicles for their operations. This includes companies that own or lease or own cars, trucks, vans or other vehicles to transport goods, equipment or people.

It is important to note that auto insurance policies generally do not cover vehicles used for business purposes. If your job requires cars, get business car insurance to protect them.

Jamie Dimon Quote: “i’ve Been Regulated My Whole Life. We Have Progressive Taxes. It’s Not A Free Market Free For All. I Completely Understa…”

Learn the difference between personal and commercial auto insurance to determine if you need commercial auto insurance.

Business selection

Progressive get a quote online, get a free quote from progressive, progressive free auto quote, progressive get auto quote, progressive get my quote, progressive insurance get a quote, progressive get a quote, get a progressive auto quote, progressive car insurance get a quote, get a quote for progressive, get a free quote progressive, progressive free online quote