Term Insurance – Insurance is a contract represented by an insurance policy in which the insured receives financial protection or indemnification from the insurance company. The company aggregates customer risks to make payments more affordable for policyholders. Most people have some kind of insurance: for their car, home, health or life.

Insurance policies protect against financial losses resulting from accidents, injuries or property damage. Insurance also helps cover the costs associated with liability (legal liability) for damage or injury caused to a third party.

Contents

- Term Insurance

- What Is Level Term Life Insurance And How Does It Work?

- What Is Term Life Insurance?

- Term Life Insurance: The Only Guide You Need

- What Is Cash Value In Life Insurance? Explanation With Example

- Limited Pay Life Insurance [sample Rates, Examples, & Pros And Cons]

- Life Insurance: Term Versus Whole — Fedmanager

- What Is Whole Life Insurance & How Does It Work?

- What Is Term Life Insurance & How To Buy It

- Gallery for Term Insurance

- Related posts:

Term Insurance

There are many types of insurance policies, and almost any individual or business can find an insurance company that will insure them – at a price. Common personal insurance policy types are auto, health, homeowners, and life insurance. Most individuals in the United States have at least one of these types of insurance, and auto insurance is required by state law.

What Is Level Term Life Insurance And How Does It Work?

Businesses take out insurance policies for industry-specific perils, for example, a fast food restaurant’s policy may cover an employee’s injury from cooking with a deep fryer. Medical malpractice insurance covers liability claims related to injury or death caused by a healthcare provider’s negligence or malpractice. A company can use an insurance broker to help manage their employees’ policies. State law may require businesses to purchase specific insurance coverage.

Insurance policies are also available for very specific needs. Such coverage includes business closure due to civil authority, kidnapping, ransom and extortion (K&R) insurance, identity theft insurance, marital liability and annulment insurance.

Understanding how insurance works can help you choose a policy. For example, comprehensive coverage may or may not be the right type of auto insurance for you. The three components of any type of insurance are premium, policy limit and deductible.

The premium for a policy is its cost, usually the monthly cost. Often, an insurer considers several factors to determine insurance premiums. Here are some examples:

What Is Term Life Insurance?

Much depends on the insurer’s perception of your risk for a claim. For example, let’s say you own several expensive cars and have a history of reckless driving. In this case, you may end up paying more for your auto policy than someone with a mid-range sedan and a great driving record. However, different insurers may charge different premiums for the same insurance policy. So it takes some effort to find the right price for you.

Policy limits are the maximum amount an insurer will pay for a loss covered under an insurance policy. The maximum amount can be set per period (eg annual or policy term), per loss or injury, or over the life of the policy. Maximum lifespan.

Generally, higher limits have higher premiums. For regular life insurance policies, the maximum amount the insurer will pay is known as the face value. This is the amount paid to your beneficiary after your death.

The federal Affordable Care Act (ACA) prevents ACA-compliant plans from setting lifetime limits on essential health benefits such as family planning, maternity services, and child care.

Term Life Insurance: The Only Guide You Need

A deductible is the exact amount an insurer pays out of pocket before paying a claim. The deductible amount acts as a deterrent for small and insignificant claims.

For example, a $1,000 deductible means you pay the first $1,000 of any claim. Let’s say the total damage to your car is $2,000. You pay the first $1,000, and your insurer pays the remaining $1,000.

A deductible may apply for each policy or claim depending on the insurer and policy type. Health plans may have an individual deductible and a family deductible. High-deductible policies are generally less expensive because small claims are usually less likely due to higher out-of-pocket costs.

Health insurance helps cover routine and emergency medical expenses, often with the option to include vision and dental services separately. In addition to the annual deductible, you may also pay copayments and coinsurance, which is a percentage of your medical benefits covered after you reach your specified copays or deductible. However, many preventive services can be covered for free before termination.

What Is Cash Value In Life Insurance? Explanation With Example

Health insurance can be purchased through an insurance company, insurance agent, employer-provided federal health insurance marketplace, or federal Medicare and Medicaid coverage.

The federal government no longer requires Americans to have health insurance, but in some states, like California, you may have to pay a tax penalty if you don’t have insurance.

If you have chronic health problems or need regular medical care, look for a low-deductible health insurance policy. While the annual premium is higher than a comparable policy with a higher deductible, the cheaper medical care throughout the year is worth the trade-off.

Homeowners insurance (also called home insurance) protects your home, other property structures, and personal property against natural disasters, unexpected damage, theft, and vandalism. Homeowners insurance does not cover floods or earthquakes, which you will need to cover separately. Policy providers typically offer increased coverage for certain properties or events and provisions that help reduce deductibles for riders. These additions come at an additional premium.

Limited Pay Life Insurance [sample Rates, Examples, & Pros And Cons]

Your lender or landlord will probably require you to have homeowners insurance. When it comes to homes, if you don’t have insurance coverage or if you’ve stopped paying your insurance premiums, your mortgage lender can purchase homeowners insurance for you and charge you for it. can get

Car insurance helps pay claims when you’re in an accident or someone else’s property is damaged, and it helps pay for auto accident repairs or theft. If the vehicle is lost, damaged or damaged, it helps to repair or replace it. natural disaster.

Instead of paying out-of-pocket for car accidents and damages, people pay an annual premium to their auto insurance company. The company will then pay all or most of the covered expenses related to the accident or other vehicle damage.

If you have a leased vehicle or have taken out a loan to buy a car, your lender or leasing dealer may require you to have auto insurance. Like homeowner’s insurance, a lender can purchase insurance for you if needed.

Life Insurance: Term Versus Whole — Fedmanager

A life insurance policy guarantees that the policyholder will pay a sum of money to your beneficiaries (such as your spouse or children) if you die. In return, you will pay a premium over your lifetime.

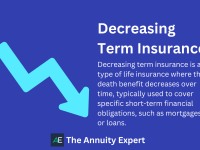

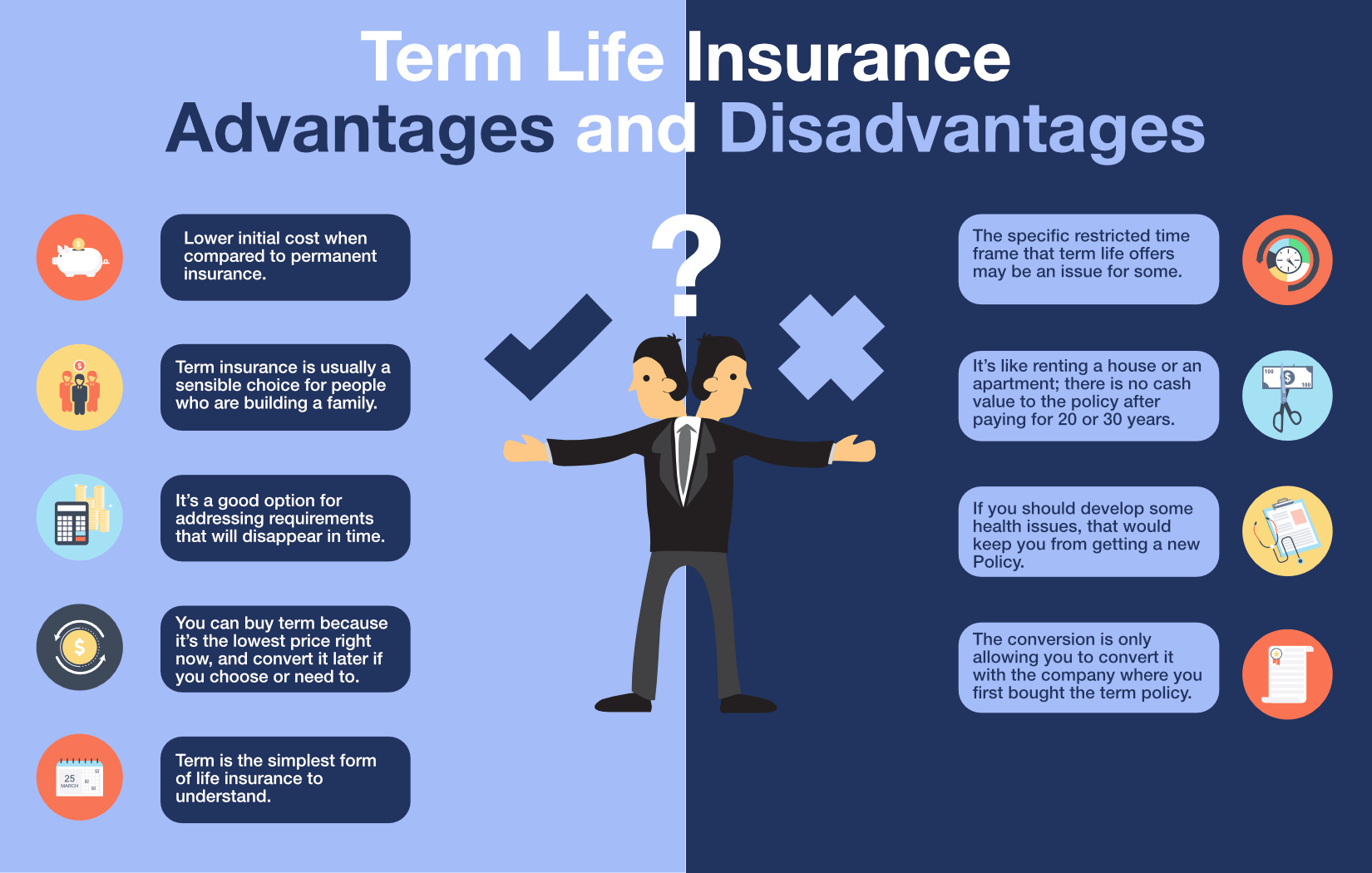

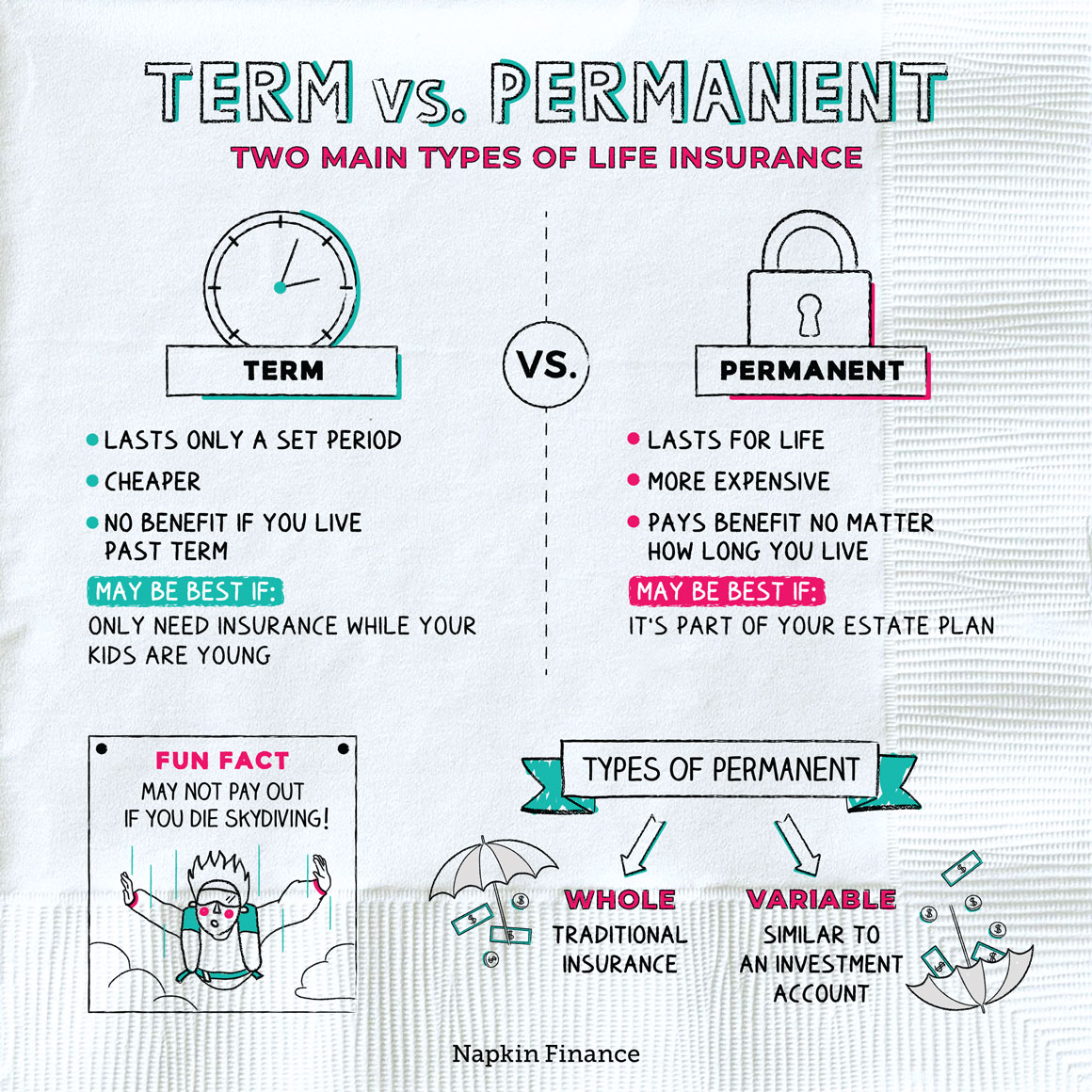

There are two main types of life insurance. Term life insurance covers you for a specific period, say 10 to 20 years. If you die during this period, your beneficiaries will receive the payment. Permanent life insurance covers your entire life as long as you continue to pay the premiums.

Travel insurance covers travel-related expenses and damages, including trip cancellation or delay, medical emergencies, injuries and evacuations, damaged luggage, rental cars, and rental homes. However, even the best travel insurance companies do not cover cancellations or delays due to weather, terrorism or pandemics. They also often don’t cover injuries from extreme sports or high-adventure activities.

Insurance is a way to manage financial risks. When you buy insurance, you get protection against unexpected financial losses. If something bad happens, the insurance company pays you or someone you choose. If you do not have insurance and an accident occurs, you may be responsible for all related costs.

What Is Whole Life Insurance & How Does It Work?

Insurance helps protect you, your family and your property. The insurer helps you cover the costs of unexpected and regular medical bills or hospitalization, damage to your car in an accident or injury to others, damage to your home or theft of your belongings. An insurance policy can pay a lump sum cash payment to your survivors if you die. In short, insurance provides peace of mind against unexpected financial risks.

Depending on the type of life insurance policy and how it is used, permanent or variable life insurance can be considered a financial asset because it can either build cash value or be converted into cash. Simply put, most permanent life insurance policies have the ability to increase in cash value over time.

Insurance can help protect you and your family from unexpected financial expenses and the risk of debt or property loss. Insurance can help protect you against costly claims, injuries and damages, death, and even the total loss of your car or home.

Sometimes your state or lender may require you to carry insurance. Although there are many types of insurance policies, some of them are life, health, homeowners, and auto. The right type of insurance for you will depend on your goals and financial situation.

What Is Term Life Insurance & How To Buy It

Writers must use primary sources to support their work. These include white papers, government data, original reports and interviews with industry experts. Where appropriate, we also refer to original research from other reputable publishers. You can learn more about the standards we follow when creating accurate, unbiased content in our Editorial Policy.

The offers listed in this table apply to compensatory partnerships. This compensation may affect how and where listings appear. This does not include all the offers available in the market.

By clicking the “Accept all cookies” button, you consent to the storage of cookies on your device to improve site navigation, analyze site usage, and assist with our marketing efforts. Life insurance is essential for families. The two most common types of life insurance are term and whole. to save

Term provider insurance, family term life insurance, lowest term life insurance, get term life insurance, guaranteed term life insurance, low cost term insurance, senior term life insurance, term life insurance quotes, affordable term life insurance, cheap term life insurance, easy term life insurance, term life insurance companies