The Cheapest Car Insurance – Andrew Hurst Andrew Hurst Senior Editor and Licensed Motor Insurance Specialist Andrew Hurst is Senior Editor and Licensed Motor Insurance Specialist at . His work has also been featured in The New York Times, The Wall Street Journal, Forbes, USA Today, NPR, Mic, Insurance Business Magazine, ValuePenguin and Property Casualty 360.

Anna Swartz Anna Swartz Senior Editor and Auto Insurance Specialist Anna Swartz is the senior editor and auto insurance specialist at , where she oversees our auto insurance coverage. She was previously a senior editor at Mic.com and a contributing writer at The Dodo.

Contents

- The Cheapest Car Insurance

- How Much Does Uk Car Insurance Cost?

- Compare Kentucky Car Insurance Rates [2023]

- Best Car Insurance For Multiple Vehicles

- Compare Car Insurance Quotes For November 2023

- Average Cost Of Car Insurance In 2023

- Best Cheap Car Insurance In California

- Very Cheap Car Insurance No Deposit Or $20 Down

- Cheapest Liability Only Car Insurance (2023 Guide)

- The Definitive Guide To Finding The Best Cheap Car Insurance

- Meridian Ranks Among State’s Most Affordable Car Insurance Rates

- Cheapest Auto Insurance Companies In 2023

- Gallery for The Cheapest Car Insurance

- Related posts:

The Cheapest Car Insurance

Content follows strict guidelines for accuracy and editorial integrity. Read about our editorial standards and how we make money.

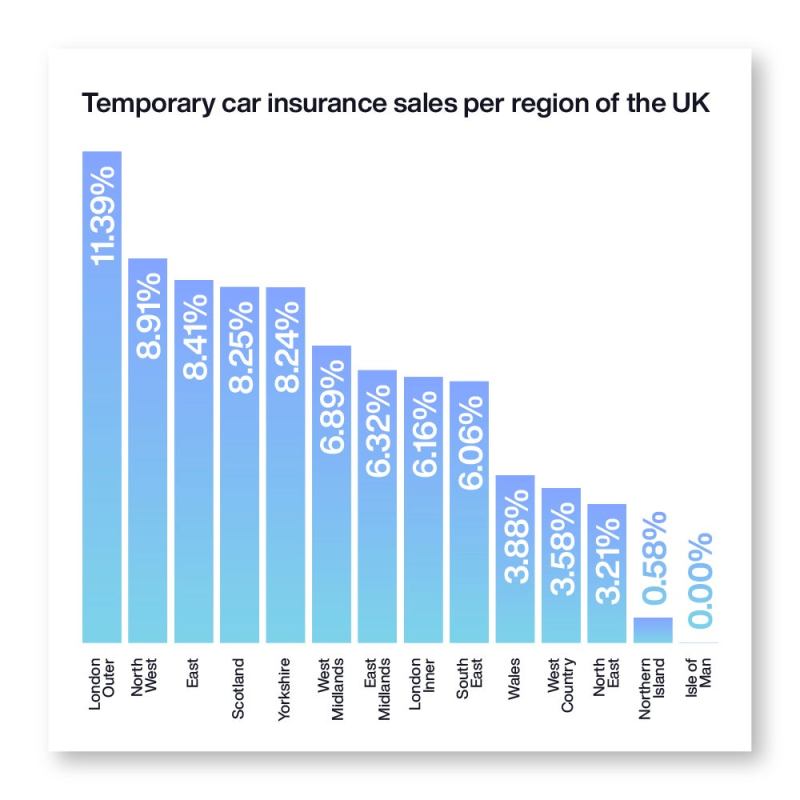

How Much Does Uk Car Insurance Cost?

We found that GEICO has the cheapest coverage for most drivers who want the minimum coverage (ie, the minimum coverage required by law). Car owners have the cheapest liability insurance overall, but it’s not available in every state.

Liability only insurance refers to a policy that does not include comprehensive or accident insurance. With liability insurance, you will only be covered for damages you cause to others in an accident, not to your own vehicle.

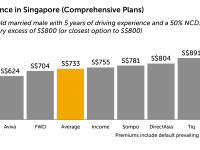

By analyzing rate data from every zip code in the country, we found the cheapest liability insurance companies. These prices are provided by Quadrant Information Services.

The rates analyzed by us are for the minimum insurance policy according to the insurance requirements in each state. The prices in this study reflect the least coverage you can get and still drive legally, but it is possible to have a liability-only policy that exceeds your state’s minimum coverage limits.

Compare Kentucky Car Insurance Rates [2023]

Rates for overall average rates, rates by postcode and cheapest company are determined using the average for drivers aged 30 years. Our model is a Toyota Camry 2017 LE, 10,000 miles/year.

To determine the cost of accident liability insurance, we calculated the average premium increase per company for full coverage. We then apply this rate of change to the average cost of a liability policy in the same company.

Some carriers may be represented by affiliates or subsidiaries. The price shown is a sample price. Your actual offer may vary.

Liability insurance costs an average of $51 per month (or $617 per year), but there are companies that offer cheaper rates than the average.

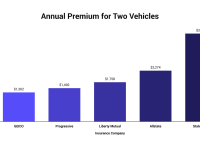

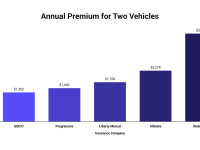

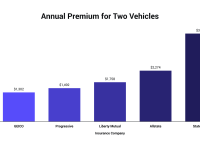

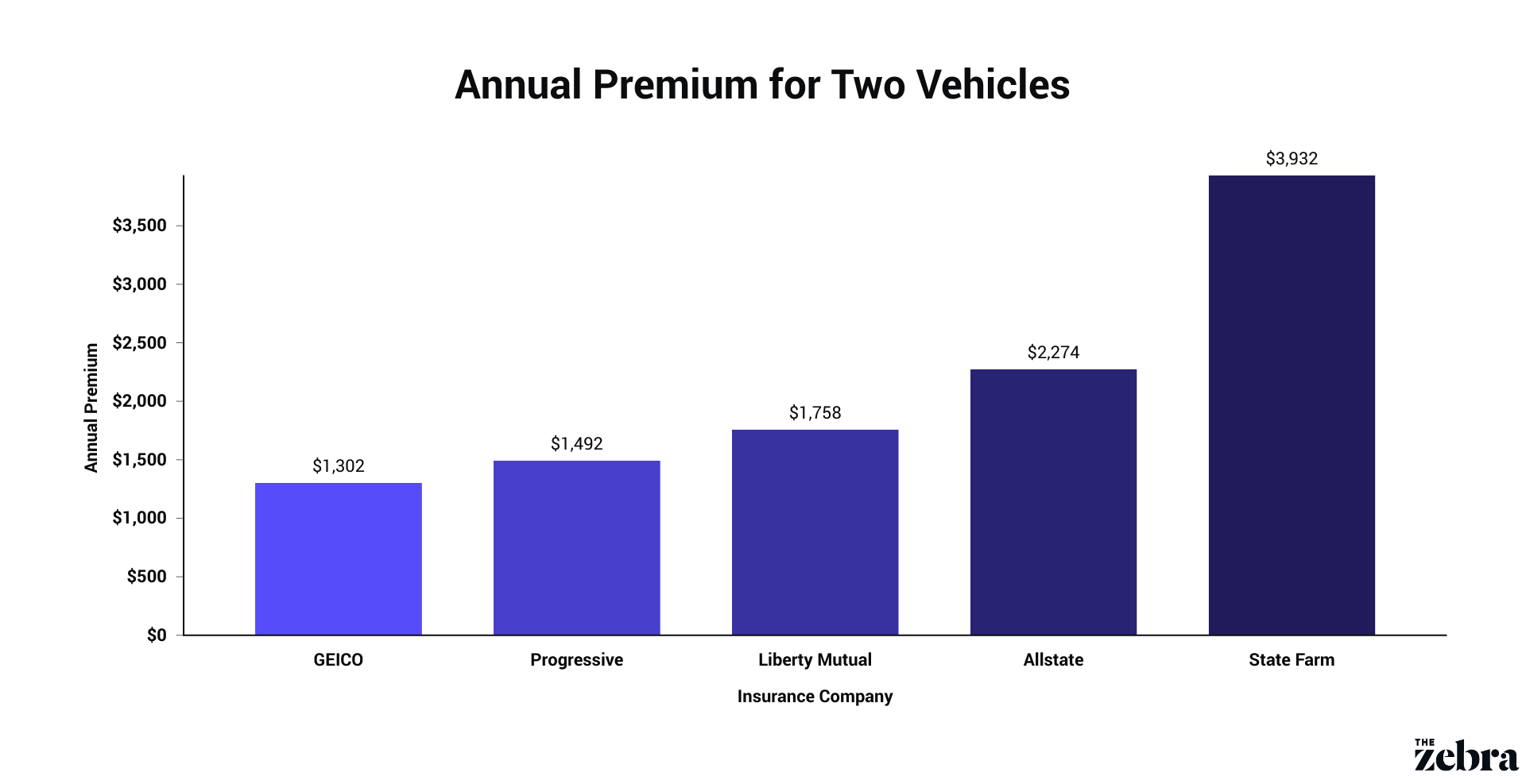

Best Car Insurance For Multiple Vehicles

We have found that the cheapest car insurance is liability insurance. On average, the cost of car owners liability insurance is $27 per month or $327 per year.

Drivers can also get some of the cheapest coverage from smaller companies like MAPFRE and Erie, as well as USAA, which only offers policies to military-affiliated drivers. But since these companies aren’t for everyone, GEICO is the cheapest liability-only insurance for most people.

Evaluation How we score: The evaluation is determined by our editorial team. Our methodology takes into account many factors, including price, financial evaluation, quality of customer service and other product-specific features.

GEICO has the best liability insurance rates of any company available nationwide. GEICO offers coverage in every state and in Washington, D.C. Drivers anywhere will be able to get a quote from GEICO.

Compare Car Insurance Quotes For November 2023

GEICO is the cheapest liability only insurance company of any company in the country. This is the only company on our list of the best with a presence in every state.

On average, auto insurance from GEICO costs only $34 per month ($402 per year). That’s cheaper than the average of $215 per year. That’s also only $35 more per year than the company with the cheapest liability insurance.

GEICO also has many discounts that drivers can take advantage of to get even cheaper rates. You can save on GEICO policies if you:

Generally, car owners have the cheapest liability-only coverage, although this type of coverage is not available in all states. But if you live in one of the 26 states where Auto Owners offers coverage, you can get liability coverage for less than $30 a month.

Average Cost Of Car Insurance In 2023

Car owners have the cheapest liability insurance of any company on our list. On average, the cost of a car owners minimum liability policy is $27 per month ($327 per year). That’s $290 a year less than the national average.

Although Auto Owners has cheap liability insurance, it is not available everywhere. Auto Owner only offers auto insurance in 26 states and does not offer coverage in California, New York or Texas.

USAA has some of the cheapest liability insurance rates, but is only offered to active and retired military members and their families. In addition to low prices, USAA has some of the best claims satisfaction ratings in the industry.

Military drivers (and their families) can get cheap liability insurance from USAA. We found that the average cost of liability insurance from USAA is $31 per month ($369 per year). That’s $248 a year less than the national average.

Best Cheap Car Insurance In California

In addition to offering great liability insurance rates for military families, USAA also has a number of discounts that drivers can take advantage of to keep costs down. You may be eligible for a discount from USAA if:

USAA also has excellent customer service. It ranks near or at the top of the J.D. satisfaction survey. Auto Claims Survey. Power every year, which means customers are happy with the claims process with USAA. [First]

Prices go up after an accident, but you can still get cheap liability insurance from State Farm. Unlike other companies that also offer cheap insurance to drivers with an accident record, State Farm is available in most states.

State Farm has the cheapest liability insurance only for people with recent accidents on their driving record. On average, we found that liability-only coverage from State Farm costs $49 per month ($585 per year) after you’re in an at-fault accident.

Very Cheap Car Insurance No Deposit Or $20 Down

We found that individual state farm liability insurance costs remained $331 per year lower than the post-accident average. There are a few companies that offer slightly lower rates for higher-risk drivers, but none are as widely available as State Farm.

State Farm doesn’t have as many discount programs as its competitors, but it does offer several savings options, including drivers:

The cost of liability insurance largely depends on where you live. In some states, the difference between the cheapest company and the average cost of insurance can be hundreds or even thousands of dollars a year.

We found that the cheapest companies at the state level were GEICO and USAA, which had the best liability insurance rates in a total of 32 states.

Cheapest Liability Only Car Insurance (2023 Guide)

Since the cheapest liability insurance company varies widely depending on where you live, it’s even more important that you compare the best deals from the best companies before buying insurance.

A liability-only policy will usually be cheaper than a comprehensive policy (which includes comprehensive and collision coverage), but it is possible to find even cheaper liability coverage.

The best way to find the cheapest liability insurance is to compare quotes from multiple companies before buying. So you can immediately know which one offers the cheapest liability insurance. You can also get cheap liability insurance:

Liability-only insurance covers only the other driver’s medical expenses and repair bills after an at-fault accident. Your policy will cover you up to its limits, which are usually per person and per accident.

The Definitive Guide To Finding The Best Cheap Car Insurance

This means your personal injury liability insurance will cover up to $25,000 for injuries to other drivers and their passengers. But you will only be covered up to $50,000 for the entire accident.

Your liability insurance does not cover damage to your own vehicle after an accident you cause. That is when comprehensive insurance is needed. Without collision and comprehensive coverage, you will have to pay to replace the vehicle yourself if you damage it in an accident.

It’s tempting to only get liability coverage instead of full coverage. Liability-only insurance costs an average of $1,035 less per year than the cost of a comprehensive policy. But most drivers must be protected by full insurance.

Liability-only insurance will not cover damage to your vehicle after an accident you cause. Although injuries and property damage to others will be covered up to your insurance limits, you will have to repair (or replace) your car yourself.

Meridian Ranks Among State’s Most Affordable Car Insurance Rates

There are times when it makes sense to buy liability-only coverage, so you may want to drop coverage altogether if:

If you only get liability coverage, you’ll still get more than the minimum amount required in your state. It doesn’t cost you much to get additional liability insurance, so you’ll get the most you can get even if you don’t get full coverage.

After a collision, the cost of someone else’s damages or injuries can easily exceed your state’s minimum liability limits. With enough insurance to drive, you can easily end up paying tens of thousands of dollars out of pocket.

If you decide to get liability insurance, it’s important to choose the highest level of coverage you can afford. If you do not have sufficient liability insurance to cover damages from an accident caused by your fault, you

Cheapest Auto Insurance Companies In 2023

Find the cheapest car insurance, how to find the cheapest car insurance, the cheapest insurance car, the cheapest car insurance company, who has the cheapest liability car insurance, what is the cheapest car insurance company, who is the cheapest car insurance, the cheapest full coverage car insurance, who has the cheapest car insurance rates, get the cheapest car insurance, whats the cheapest car insurance, who has the cheapest car insurance