Third Party Car Insurance – The proposed increase in third party (TP) motor insurance premium is not consistent with market reality and additional ground information should be used while finalizing market premiums, said Shanai Ghosh, CEO, Edelweiss General Insurance.

The Insurance Regulatory and Development Authority of India (IRDAI) in its notification has proposed a draft notification on long-term 2-wheeler TP rates, while nominal increases have been proposed for private cars and commercial vehicles. In addition, a 15 percent discount is offered on electric bikes and cars and there is a 7.5 percent discount on hybrid vehicles.

Contents

- Third Party Car Insurance

- How To Lower Your Motor Insurance Premium? — Third Party, Comprehensive And Pay As You Drive Policy Explained

- Does Third Party Insurance Cover Passengers?

- Third Party Insurance Policy, Is It Worth It?

- Green Car Insurance

- How To Make A Third Party Insurance Claim

- Third Party Car Insurance: The Cheapest Car Insurance 2023?

- What Is Third Party Insurance (tpi)

- Gallery for Third Party Car Insurance

- Related posts:

Third Party Car Insurance

“The last two years were not a representative time to judge the increase in prices because of COVID. The reason is that cars are doing less, but the courts are in operation. So whatever judgments or small judgments we have received, a huge increase has also been set for motor vehicles with lower thresholds. Therefore, prices should really be examined They are. The toilet that the industry feels does not rise in proportion, because they look at the experience in these years that is not representative at all. The growth and the growth of claims will be much higher than what was predicted in the draft price hike,” said Ghosh.

How To Lower Your Motor Insurance Premium? — Third Party, Comprehensive And Pay As You Drive Policy Explained

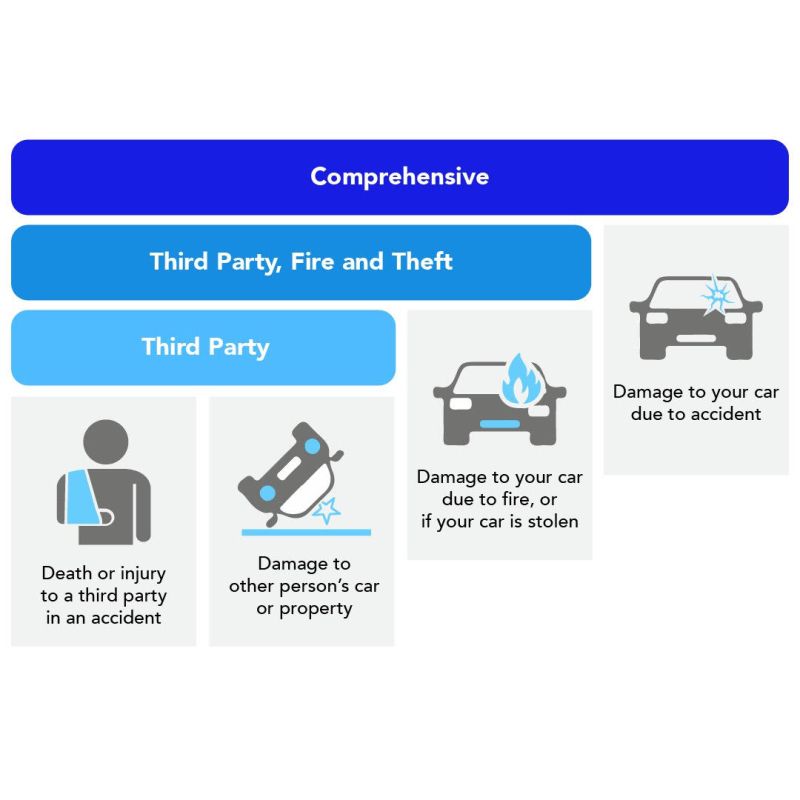

Motor insurance premium rates include both property damage and third party benefits. While your own car insurance covers damage, third party insurance provides cover against third party liability. In India it is mandatory to buy third party motor insurance.

After two years due to the COVID-19 pandemic, the revised premium of TP insurance will be effective from April 1. Earlier, the TP rates were notified by IRDAI, but from this time the road transport ministry will notify the TP rates in consultation with the regulator. According to the proposed revised rates, private cars with 1,000 cubic (cc) capacity will have a premium of Rs 2,094 compared to Rs 2,072 in 2019-20. Similarly, private cars with 1,000 cc to 1,500 cc will have premium rates of Rs 3,416 compared to Rs 3,221. For cars above 1,500 cc, a premium of Rs 7,897 will have to be charged, two-wheelers above 150cc, but not exceeding 350cc will attract. the premium will be Rs 1,366 and for two cars above 350cc the revised premium will be Rs 2,804.

Insurers complain that although third-party motor vehicle premiums have remained unchanged for the past few years, the amount of premiums has increased over the years.

“It has been years since the third party motor premium has not changed, since the amount of premium has been increased due to various premiums. But this is the only option and we have to wait for the last round to analyze the impact of the same,” said TA Ramalingam, Chief Technical Officer, Bajaj Allianz General Insurance.

Does Third Party Insurance Cover Passengers?

The industry notes that the TPA premium rates offered for this financial year are based on two years’ experience which is not representative of current losses and therefore requires the use of additional market information.

“The proposed price increase is based on actuarial calculations. So, in fact, we will look at the calculation of past experience and see the data received. So those calculations are correct, but what we are trying to assert is that the calculations are not representative of the last two years of experience and therefore underestimate the demand or need or increasing the amount of prices. We will give some additional knowledge of the market about the type of premiums given and how the minimum thresholds have been increased. The time of sale is going down, which is good for the customer. But for gas insurers it means that the income will also go down. Therefore, it will be a loss to the financial health of health insurance. So some we have to use basic information to decide rates and not look at past experience,” said Ghosh, noting that this is the first time MorTH has engaged third-party rates consultants with the Insurance Regulatory and Development Authority. India (IRDAI).

The government has announced an increase in third party motor insurance premiums for various categories from June 1. The revised rates are expected to increase the cost of car and two-car insurance. This is the first time that MORTH has notified third-party rate consultants with the Insurance Regulatory and Development Authority of India (IRDAI).

According to the Ministry of Transport and Highways (MoRTH), private cars with an engine capacity of 1,000 cc will go at rates of Rs 2,094 compared to Rs 2,072 in 2019-20, when the rates were last revised. Prices have been maintained unchanged due to the COVID-19 pandemic.

Third Party Insurance Policy, Is It Worth It?

Rates for private cars with engine capacity between 1,000 cc and 1,500 cc will increase from Rs 3,221 to Rs 3,416. However, rates for cars above 1,500 cc will see a reduction in premium from Rs 7,897 to Rs 7,890.

Two lease holders will also have to pay Rs 1,366 for bikes of 150 cc but not exceeding 350 cc, and Rs 2,804 for above 350 cc.

The ministry said a 7.5 percent discount was allowed on the premium for hybrid electric vehicles. While private electric cars not exceeding 30KW will attract a premium of Rs 1,780, those exceeding 30 KW but not 65 KW will attract a premium of Rs 2,904.

This is insurance for any collateral damage caused to another party, usually a person, due to a road accident. Third party insurance has to do with own damage insurance that must be purchased.

Green Car Insurance

A 15 percent discount is granted for educational purposes. The service also offers a 50 percent discount on the premium for private cars registered as vintage cars. The third party or the joint? What to buy? This is one of the biggest questions that comes to mind when buying car insurance.

In Third Party Insurance, the maximum limit is Rs 7.5 lakhs for property damage Having your own car is a dream come true. And to drive legally in India, you need a Third Party Motor Insurance policy. It covers…

When is it time to add my baby to the family ‘swim’ plan? The birth of a child brings immense joy, but also some great responsibilities! To get some tips from, Family Floating Health plan…

Are road ambulance charges covered by health insurance plans? By accident, patients need immediate health care. Ambulances are equipped with medical equipment to provide emergency care. Most…

How To Make A Third Party Insurance Claim

What is TPA? What are its functions? A TPA or Third Party administrator is an external agency for processing insurance claims. IRDAI are licensed. Insurance companies…

The ChatGPT hype is over — now Watch how Google will kill ChatGPT. This never happens immediately. The business game is longer than you know.

For 10 seconds, they had been married for 20 years in August in northern Virginia, hot and humid. However, I did not run the trail in the morning. I wear my stay at home mom…

Five. Insert three hundred. Millions of thousands. The year was 2008, about a year after Twitter was officially established. It was Monday. I woke up in our book on the Berkeley site and, for … Third party insurance is a plan purchased by the insured (first party) from the insurance company (second party) to protect them from claims of another (third party). A common example of third party insurance is car insurance, which is designed to protect you from other drivers in the event of an accident.

Third Party Car Insurance: The Cheapest Car Insurance 2023?

Third party insurance is essentially a form of liability insurance. The first part is the loss or damage regardless of the cause of the damage. One of the most common types of third party insurance is car insurance.

The third party offers insurance against losses and damages claimed by the driver who is not healthy, the principal, and therefore not covered by the insurance policy. The driver who caused the damage is a third party.

In some cases third party insurance may be required by law. Drivers, for example, must carry at least minimal bodily injury liability and property damage liability. These coverage requirements vary from state to state. Some states do not require both or have other restrictions. Each state sets its own minimum requirement for each type of coverage.

Even in “no-fault” states, liability coverage is nearly essential. No fault laws do not protect you from multi-million dollar injury lawsuits arising from a seriously injured third party.

What Is Third Party Insurance (tpi)

No-fault laws have reduced or eliminated common injury lawsuits based on low dollar gun prices and the largest number of pain and suffering claims.

Both types of third party insurance are important to individuals, such as homeowners, who have significant assets to protect. The more money and assets one has, the higher the rate for each type of liability insurance.

In most countries, third party or liability insurance

Third party car insurance quote, cheapest third party car insurance, best third party car insurance, third party rental car insurance, third party cheap car insurance, car insurance third party, car insurance third party liability, third party car insurance rates, third party car insurance compare, third party car insurance companies, third party car insurance online, third party car insurance price