Cheap Insurance Companies – Vehicle insurance is insurance for cars, trucks, motorcycles and other road vehicles. Its primary purpose is to provide financial protection against bodily injury or bodily harm resulting from traffic collisions and liability arising from motor vehicle incidents. Car insurance can also provide financial protection against vehicle theft, as well as damage caused by non-traffic collisions such as key lockouts, weather or natural disasters, and collisions with stationary objects. The specific conditions of car insurance vary depending on the legislation of each region.

Money Yug is a one stop solution for complete wealth management services. We are unbiased financial experts with a proven track record of helping you manage your finances simply and effortlessly – like how to plan, where to invest, what insurance to buy, how to get the best credit card and all kinds of credit options; all under one roof.

Contents

- Cheap Insurance Companies

- The Best Affordable Car Insurance Companies For 2020

- Car Insurance Online

- Cheapest Car Insurance Companies (november 2023)

- Cheapest Car Insurance In Georgia (december 2023)

- Motor Insurance Companies To Choose From In India

- Myths Associated With Car Insurance Policy

- German Car Insurance Market

- Top 5 Car Insurance Companies In India 2021

- Gallery for Cheap Insurance Companies

- Related posts:

Cheap Insurance Companies

We’re excited to make a difference by changing the way you coordinate your finances to ensure maximum return on investment. Over the years, we have gained unparalleled expertise in cutting-edge financial and investment planning with unparalleled services.

The Best Affordable Car Insurance Companies For 2020

Apartment number 1509 on the 15th floor, R.g. Trade Tower, Netaji Subhash Place New Delhi – 110034, India

Terms of use – Privacy policy – Link to us Copyright © 1996-2023 InterMESH Ltd. All rights reserved. Partner Content: This content was created by a Dow Jones business partner and independently reviewed and written by the newsroom. Links in this article may receive a commission. Read more

Written by Daniel Robinson Written by Daniel Robinson Author Daniel is a writer for the Guides team and has written for a number of automotive news sites and marketing companies in the US, UK and Australia on car finance and car care topics. Daniel is the authority on the guide team when it comes to car insurance, loans, warranty options, car services and more.

Edited by Rashawn Mitchner Edited by Rashawn Mitchner Managing Editor Rashawn Mitchner is a Guide team editor with over 10 years of experience covering personal finance and insurance topics.

Car Insurance Online

Reviewed by Mark Friedlander Reviewed by Mark Friedlander Consultant Mark Friedlander is director of corporate communications at the Insurance Information Institute (Triple-I), a New York-based nonprofit research and education organization dedicated to improving consumer understanding of insurance. Mark serves as a national spokesperson for Triple-I and handles a wide range of media issues for the insurance industry. Her responsibilities include leading the association’s hurricane season communications strategy, as well as member business support and media outreach in Florida, where she is based.

We at Guides have researched dozens of top car insurance companies to find out which providers offer the cheapest car insurance rates. In this guide, we highlight the cheapest car insurers, rates and quotes, and explain our top picks in full detail.

Average Cost Of Car Insurance 2023 Best Car Insurance Companies 2023 How To Get Discount Car Insurance Cheapest Car Insurance How Much Car Insurance Do I Need? Types of car insurance

Our team of guides are committed to providing you with reliable information to help you make the best possible decision about insuring your vehicle. Because consumers trust us to provide objective and accurate information, we’ve created a comprehensive rating system to rank the best auto insurance companies. We collected data from dozens of auto insurance providers to evaluate companies based on a wide range of ranking factors. After 800 hours of research, the final result was the overall evaluation of each service provider, with the insurance companies with the most points leading the list.

Cheapest Car Insurance Companies (november 2023)

Of the major national auto insurance companies, Geico offers the cheapest average premium ($38 per month and $461 per year) for minimum liability coverage. This data point and all other cost data in this article are from Quadrant Information Services. In most states, minimum car insurance is the cheapest option available because it only pays for other people’s medical bills and property damage from accidents you cause. It is important to note that the cheapest car insurance available varies from driver to driver.

Insurance experts recommend that drivers carry liability insurance limits above the state minimum for better financial protection against at-fault accidents.

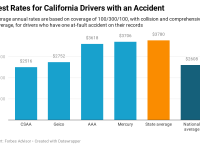

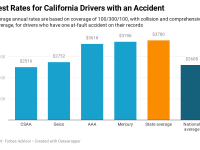

Because insurance premiums are based on personal criteria such as location, driving history and credit score, the best place to get car insurance is not the same for everyone. Here are the companies that offer the cheapest car insurance options on average for multiple driver profiles:

*Premium averages mentioned above include valuation estimates based on a 2022 Toyota Camry driven by a single 35-year-old with good credit and a clean driving record, unless otherwise noted.

Cheapest Car Insurance In Georgia (december 2023)

When it comes to the big national carriers, Nationwide, Geico, State Farm, Travelers and Liberty Mutual offer the best rates. The criteria used to determine the cheapest car insurance companies take into account Quadrant Information Services’ minimum liability and total coverage estimates, as well as the number of discounts each carrier offers.

The table below shows the aggregate cost classification, the average prices for minimum liability and comprehensive coverage, and the number of discounts offered by the cheapest national car insurance companies:

* While USAA received the highest cost score, its services are limited to active duty military members, veterans and their families.

**The above estimates are based on a 2022 Toyota Camry driven by a single 35 year old male with good credit and a clean driving record. Our cost classification takes this information into account as well as other factors such as discount types and amounts.

Motor Insurance Companies To Choose From In India

Some of the cheapest regional auto insurance companies include United Mutual, Pemco, Farm Bureau, MMG, and Safety Insurance. There are many regional car insurance companies operating throughout the country, so it is worth comparing the prices of companies in the area in addition to the national service providers.

National and state specific car insurance premiums for minimum liability and comprehensive car insurance are highlighted below. The national average cost per company is based on our estimated analysis of a 35-year-old single driver with good credit and a clean driving record. While minimum liability coverage is the cheapest level of coverage available in most states, most auto insurance quotes include a comprehensive coverage estimate for those who want a higher level of coverage. We recommend that you evaluate both types of coverage.

Auto-Owners, USAA, Geico, State Farm and Nationwide offer the cheapest minimum liability insurance premiums. According to our data, between 2022 and 2023, average minimum car insurance premiums remained roughly unchanged and decreased by 1%. The table below contains the full list of companies offering the cheapest state minimum cover:

Nationwide offers the cheapest comprehensive car insurance from a major national carrier, with an average premium of $119 per month ($1,433 per year). Nationally, Travelers, Geico, Auto-Owners and State Farm are affordable for comprehensive coverage. According to our cost data, from 2022 to 2023, the prices of comprehensive car insurance increased by an average of 16%.

Myths Associated With Car Insurance Policy

Depending on which state you live in, the cheapest auto insurance rates can be significantly lower or higher than the national averages discussed earlier. The cheapest provider also varies significantly from state to state.

In the sections below, we highlight the carriers that offer the cheapest auto insurance rates in each state for minimum liability and comprehensive auto insurance.

The chart below shows the cheapest minimum liability coverage in all 50 states and Washington, D.C. Each row lists the cheapest corporate and annual cost estimates for each state’s lowest rate:

*USAA offered the cheapest rates in many states, but since coverage is only available to military members and their families, cost figures are not included in this chart.

German Car Insurance Market

Below are the cheapest comprehensive car insurance rates in each state. Each row lists the cheapest corporate and annual cost estimates for each state’s lowest rate:

*USAA offered the cheapest rates in many states, but since coverage is only available to members of the military community, this chart does not include cost figures.

While the cost information above can help you find the best rates available, you can’t know for sure what your price might be until you compare car insurance quotes. In addition to location and level of coverage, car insurers take into account several personal factors when deciding how much you should pay for insurance.

In the sections below, we break down the cheapest car insurance quotes for drivers who fall into several categories that are important when determining car insurance rates, including age, driving history and credit.

Top 5 Car Insurance Companies In India 2021

Age plays a key role in determining car insurance premiums. Drivers of a certain age, usually teenagers and the elderly, are considered to be at a higher risk than most drivers and may have higher rates. In the sections below, we highlight the cheapest car insurance rates for young drivers and seniors.

Sixteen-year-olds pay an average of $7,378 for individual comprehensive insurance. This amount applies to drivers aged 16 who are on the vehicle’s title and use their parent or guardian to purchase their own insurance. Adding a teenager to your family policy can save you hundreds of dollars each year. Car owners, Nationwide and Geico offer the cheapest

Cheap homeowners insurance companies, cheap online insurance companies, cheap life insurance companies, cheap commercial insurance companies, cheap house insurance companies, cheap health insurance companies, cheap home insurance companies, cheap motorcycle insurance companies, insurance companies cheap, cheap online car insurance companies, cheap auto insurance companies, cheap sr22 insurance companies