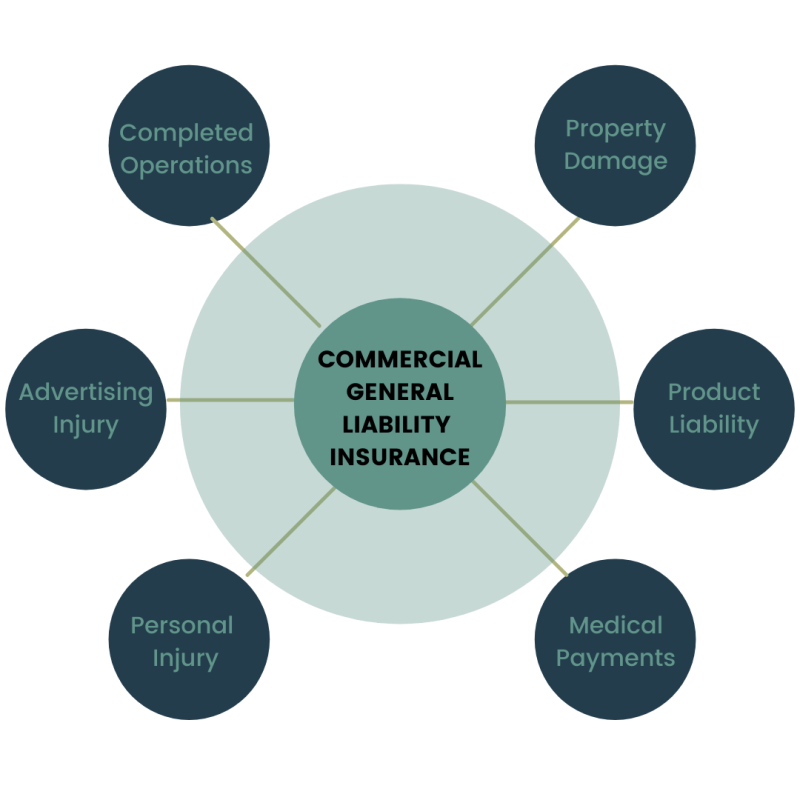

General Liability Insurance – What is General Liability Insurance Commercial General Liability (CGL) is business insurance written to cover third party claims for bodily injury, property damage or bodily injury or issues – to cover the law. Most general liability insurance policies in Oklahoma (OKC) and across the country are very broad and cover some of the following exposures:

Most small businesses in Oklahoma and the US require General Liability Insurance coverage. If you rent or own an office or commercial space, the insurance provided by a Commercial General Liability (CGL) policy is necessary or necessary for business. In fact, one of the first steps small businesses take when setting up shop is to purchase a CGL to protect their business foundation.

Contents

- General Liability Insurance

- A Comprehensive Guide To Liability Insurance (2023)

- General Liability Insurance Quote

- Do I Need Professional Liability Or General Liability Insurance?

- How Much Is General Liability Insurance For Small Business? Get Quotes And Rates

- Buy General Liability Insurance Policy. Online Quotes, F.a.q San Diego, California

- What Ever Happened To Comprehensive General Liability Insurance?

- Liability Insurance: What It Is, How It Works, Major Types

- Orlando General Liability Insurance

- What Is General Liability Insurance

- General Liability Insurance Certificate South Florida Council, Boy Scouts Of America

- Gallery for General Liability Insurance

- Related posts:

General Liability Insurance

The policy varies depending on the type of business you have. Property type exposures tend to be sorted by area, while services and construction tend to be sorted by Sales or Payment. Each policy will have a page that lists your exposures and codes, the priority basis and the exposure they use to determine your premium. You should check them to make sure they are correct.

A Comprehensive Guide To Liability Insurance (2023)

General liability insurance limits, whether you are in Oklahoma City (OKC) or another state, can vary, but the typical limits available are $1,000,000 per occurrence. General liability insurance will also have one or more “aggregates”, the amounts being the maximum a policy can pay in one year for this type of cover.

The standard policy will be “All Completed Products and Features” and “General Collection” for claims other than Completed Products or Features. If you want to have a higher general liability insurance limit than 1 or 2 million, you must purchase a commercial umbrella or excess liability insurance.

Entries are used to modify the general liability insurance policy. Some agreements extend coverage while others limit coverage. These can be used to tailor general liability insurance for your type of business. Some commonly used deal types are: Start your free trial, then enjoy 3 months for $1/month when you sign up for a basic or basic monthly plan.

Start a free trial and enjoy 3 months for $1/month on select plans. Register now

General Liability Insurance Quote

Try it for free and explore all the tools and services you need to start, run and grow your business.

When Henry Walker went to pick up a watermelon at Walmart, he didn’t expect to be disabled. But that’s exactly what happened: his foot caught on a suitcase when he reached the watermelon and he fell so hard that he broke his thigh. When the case went to court, they found video evidence that Walker was not the first person involved in the racket, and the court awarded him $7.5 million in damages.

But Walmart didn’t have to pay that settlement out of pocket. Instead, general liability insurance likely covered the cost. And while it’s unlikely your business will be hit with a settlement, even a medium-sized lawsuit can be devastating for small business owners.

General liability insurance is a type of business insurance that covers you for general third-party claims against your business, including bodily injury and property damage. It is sometimes called business liability insurance or commercial general liability insurance.

Do I Need Professional Liability Or General Liability Insurance?

Despite having “general” in the name, general liability insurance provides liability coverage for claims related to certain specific things: injury to a customer at your place of business, damage caused by you or someone working on the customer’s property , reputational damage you cause. to someone else and advertising damages such as copyright infringement.

General liability insurance provides third party coverage, which means payments go to the third party involved in the claim, not directly to you. “First party” and “third party” are considered to be a person who has been injured – physically, financially or reputationally.

General liability insurance typically covers claims related to a customer injury at your place of business, an employee damaging a customer’s property, reputational damage, and advertising injuries such as copyright infringement.

General liability insurance covers claims related to natural hazards such as bodily injury and property damage to third parties. Professional indemnity insurance covers intangible risks, such as errors and omissions damages, when your client has suffered financial loss because of bad advice or another mistake you make.

How Much Is General Liability Insurance For Small Business? Get Quotes And Rates

No, general liability is not based on income. Instead, it’s mostly based on how risky your business is. Other factors that can affect the cost of general liability include how many employees you have, where you are located, how old your company is and previous insurance claims.

Soon you will start receiving free tips and resources. In the meantime, start building your store with a free 3-day trial .

Sign up for a free trial to get access to all the tools and services you need to start, run and grow your business.

Try for free, no credit card required. By submitting your email, you agree to receive marketing emails from .

Buy General Liability Insurance Policy. Online Quotes, F.a.q San Diego, California

Try it free for 3 days, no credit card required. By entering your email, you agree to receive marketing emails from. General liability insurance helps protect your small business from claims that it caused personal injury or damage to other people’s property. Without general liability coverage, you would have to pay for these claims out of pocket. General liability insurance (GLI) can be called many different things, such as business liability insurance, commercial general liability insurance, or comprehensive general liability (CGL).

Just remember that general liability insurance costs are different for everyone because every business is unique. Factors that can determine this cost include:

Did you know that four out of 10 small business owners will likely face a property or general liability claim in the next 10 years?

Claims range from unexpected events, such as a burglary, to unexpected accidents, such as a customer being injured after a slip and fall.

What Ever Happened To Comprehensive General Liability Insurance?

A question we often hear is, “Does my small business need general liability insurance?” Chances are, the answer is yes. With general liability insurance, you will be protected against claims from:

If a customer is injured on your premises, this policy can help cover their medical bills.

Employees sometimes damage customer property while delivering products or services. Your GL policy will help pay for the damage.

General liability insurance policies can help cover malicious prosecution, defamation, defamation, wrongful eviction and invasion of privacy.

Liability Insurance: What It Is, How It Works, Major Types

If your rental property is damaged by fire, lightning or explosion, your general liability policy can help you pay for repairs.

Public liability insurance cover will help protect you against costly general liability claims that may arise in normal business situations, such as:

You may also need this coverage if your customers request it. Many customers want to confirm that you have general liability coverage before signing a contract with your business. You can prove that you have general liability insurance with a certificate of liability insurance.

General liability insurance does not cover all types of claims. Depending on your small business, you may need different types of coverage to give your business more protection. A general liability insurance policy does not cover commercial auto accidents, employee injuries or illnesses, damage to your business property, professional errors or mistakes, willful crimes or wrongful acts, or any claims that cost more than the limits of liability. It also doesn’t cover claims related to data breaches or loss of revenue if your business can’t open due to damage to covered property.

Orlando General Liability Insurance

State laws generally do not require business owners to carry general liability insurance. But it’s still a good idea to have this liability insurance. If a customer sues your business and you don’t have coverage, it can put your business finances and personal assets at risk.

It is important to understand your state’s general liability insurance laws. Work with a local insurance agency or small business insurance specialist group to help you choose the right business liability insurance.

While LLCs are not required by state law to carry business liability insurance, it is a good idea to protect your business against everyday risks. Without it, you would have to pay out of pocket for claims against your business, which can be costly. Talk to an underwriter or get a quote online today and see how we can protect your LLC.

When you’re ready to get a general liability quote, you’ll want to have the right information handy. This includes the following:

What Is General Liability Insurance

Not all insurance companies are the same. It’s important to work with someone you can trust. We have over 200 years of experience helping small business owners protect their companies with coverage such as general liability insurance.

Whether you’re looking for a quote, trying to understand general liability category codes, or need help filing a claim, we’ve got your back.

To find out more, start a free quote or get your general liability insurance online. We can also help you obtain other essential business coverages, such as commercial property insurance and commercial auto insurance.

“I was very pleased with the quote and general liability policy I received for my small business. I would recommend TheHartford without reservation. “

General Liability Insurance Certificate South Florida Council, Boy Scouts Of America

“I’m enjoying myself

General liability insurance colorado, general liability insurance indiana, best general liability insurance, temporary general liability insurance, general liability insurance ohio, general liability insurance houston, general liability insurance sc, general liability insurance louisiana, general liability insurance alabama, general liability insurance georgia, buy general liability insurance, general liability insurance arizona