Online Auto Insurance – When looking for car insurance, you need to be prepared. We’ve put together the best tips for buying car insurance online. (iStock)

Buying car insurance online is as simple as buying anything else. Being able to shop on any device not only makes it easy, but you can also compare quotes across a wider network when shopping online.

Contents

- Online Auto Insurance

- Compare Auto Insurance Quotes

- Free Auto Insurance Quotes

- Best Car Insurance Companies In Los Angeles

- Buying Car Insurance Online: How To Do It (2023 Tips)

- Ca Online Auto Insurance Quotes

- How To Buy Car Insurance (consumer Guide)

- Online Car Insurance Quote

- Why Should I Compare Free Car Insurance Quotes Online?

- Gallery for Online Auto Insurance

- Related posts:

Online Auto Insurance

In fact, Credible makes online car shopping easy, providing users with an overview of the right coverage options and the ability to compare quotes online for free. Visit Credible today to get started.

Compare Auto Insurance Quotes

Once you make your purchase, you can expect immediate coverage. As with everything, there are best practices that will help one in the process of buying car insurance online. Here are three tips to follow as you begin your search.

First, car insurance requirements vary and buyers should do their homework and choose the right car insurance coverage. The amount of coverage you need may depend on other factors, such as your property, other insurance, and the type of vehicle covered. Here are six common coverage and policy options to consider when you start shopping:

There are additional options available for car insurance policies. This is why potential buyers should shop around and do their research. You can research prices and find the right car insurance plan for your needs at Credible.

Each car insurance company has a formula for calculating car insurance rates, which is why shoppers should compare quotes. You may pay less with one company than another for the same coverage plan.

Free Auto Insurance Quotes

Comparing multiple insurance quotes can save you hundreds of dollars a year. And it’s really easy to get a free quote in minutes through our Credible partners here.

When you compare rates, choose the auto insurance policy that fits your needs, budget and state requirements.

Providers require specific information to get the correct rate when purchasing car insurance online. Here’s what you should have:

Providing materially false information or withholding important details to reduce your premiums may result in denial of your coverage, loss of your policy, fines, higher premiums, or legal action. If you want your claim to be paid if something happens, make sure you are honest with your insurer. Once you have your information ready, you can compare car insurance companies and purchase their plans on Credible.

Best Car Insurance Companies In Los Angeles

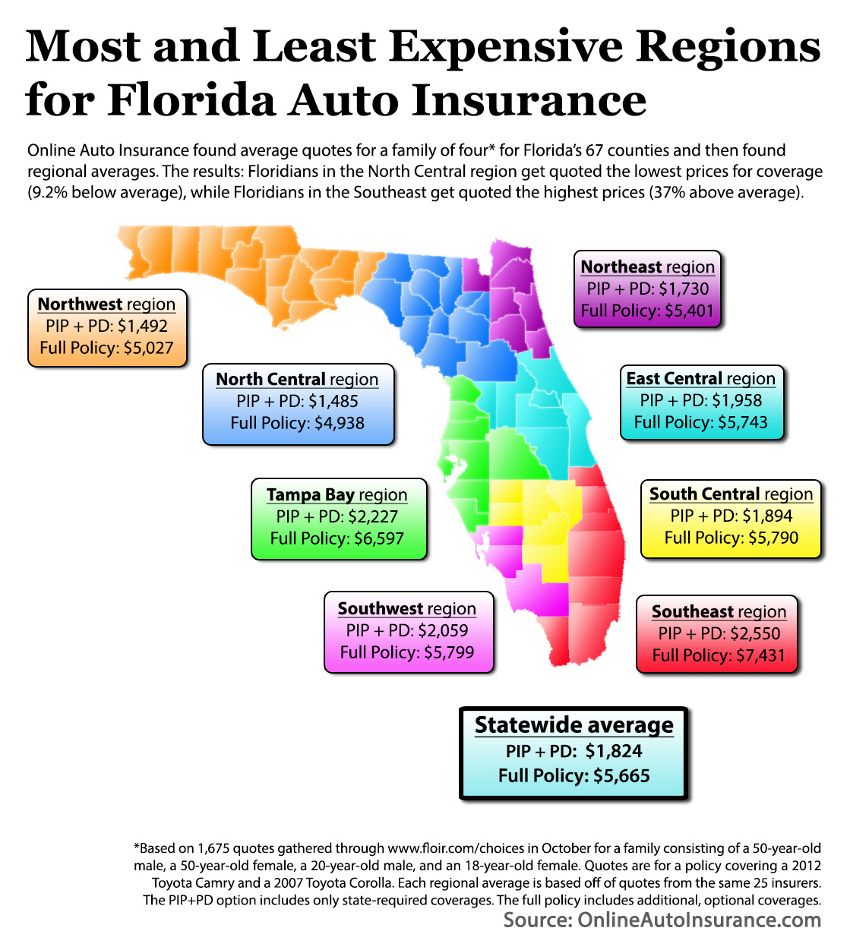

When looking for car insurance, the importance of shopping around and comparing can’t be overemphasized. Comparing quotes is important, but it can take time. With a trusted partner, you can eliminate the time-consuming part of your search. Do you understand your current auto insurance policy? Car insurance can be difficult to find; everyone knows that. But what if it doesn’t have to be that way? By going online and getting free auto insurance in Florida, you will be able to find what you are looking for more easily. This is because you can find out exactly what car insurance companies offer for drivers like you and choose the policy that fits your budget and needs. Are you looking for the smallest state? You got it! Do you want to get additional coverage for your favorite car? No problem!

You want to find a Florida auto insurance agency that offers strong and flexible auto insurance options. They will provide you with excellent coverage and great rates, because they know that your car insurance is more than just a basic obligation. Of course, you want to be able to customize your policy with the option to choose from multiple policy packages, for one, three or six months. You should be able to choose additional options for liability, collision and OTC, personal injury protection, roadside assistance, and more. Look no further – the answer is Pronto Insurance!

Get a quote online from Pronto Insurance today and you will find that your car insurance is easy, convenient and affordable. By getting a quote today, your budget and coverage can be better for you when your next car insurance payment is due. Wouldn’t it be nice to have extra money next month, better coverage in case of an accident, or both? Soon Insurance can do it for you! Our goal is to help you make an insurance decision with confidence. We have advertising links with some of the services on this page. However, this does not affect our judgment or recommendation. Our rating and listing of reviews, tools and all other content are based on objective analysis and we take full responsibility for our reviews.

Compare car insurance quotes to see which company offers the coverage you want at the price you want to pay. Doing a car insurance comparison will save you money.

Buying Car Insurance Online: How To Do It (2023 Tips)

Laura is an award-winning editor with content and communications experience covering auto insurance and personal finance. He has written for several media outlets, including the USA Today Network. He most recently worked in the public sector at the Nevada Department of Transportation.

John is the managing editor of Insurance.com and Insure.com. Prior to joining QuinStreet, John was an associate editor at The Wall Street Journal and has been an editor and reporter at other media outlets covering insurance, finance, Personal loans and technology.

Dr. Gao is director of risk and insurance policy, teaching at Eastern Kentucky University.

Whether you’re looking for new car insurance or thinking about switching, comparing car insurance rates is the best way to find great deals on car insurance.

Ca Online Auto Insurance Quotes

Comparing auto insurance quotes is a simple process that can save you hundreds of dollars a year. Our team of experts have compared car insurance plans to bring you this data-driven guide.

To compare car insurance rates, see the comparison of companies at three levels in the table below. The rates shown are annual averages for:

To compare car insurance rates, you must first decide how much coverage you need and have details about your car, its location and the driver. Also keep in mind the difference between comparing car insurance rates and comparing car insurance:

You will receive a quote during your research, but the actual amount you pay for coverage (your rate) may be higher or lower after the insurance company completes the calculation.

How To Buy Car Insurance (consumer Guide)

Here are five steps you can take to compare car insurance quotes and find the best car insurance deal:

If you’ve moved or want to get an idea of car insurance prices in your area or are a new driver, you can get an idea of what people pay in your area by using our comparison tool car insurance, which shows the average car insurance rates for each zip code.

California Auto Insurance Rates by Zip Code Enter your zip code to get the average rate. Then enter the age level, gender and coverage to get the special rate.

Minimum State: Liability coverage required for a legal vehicle in your state; Some states require additional coverage, such as personal injury, uninsured and uninsured motorist coverage. 50/100/50 Liability Only: $50,000 per person / $100,000 maximum per accident for bodily injury; $50,000 for property damage. Liability pays for injuries/damages caused by others. 100/300/100 Comprehensive Coverage: $100,000 per person / $300,000 maximum per accident for bodily injury; $100,000 for property damage; Comprehensive and collision coverage with a $500 deductible. Liability pays for injuries/damages caused by others. Full and collision coverage for damage to your vehicle.

Online Car Insurance Quote

Quadrant Information Services has provided auto insurance rate reports for the 2017 Honda Accord for all zip codes in the United States. We calculated the rates using data from six major operators. The average for the wrong product is based on the monthly insurance for a male driver, age 30, for the minimum coverage required by the state. The average rating is based on the driver’s age and gender in the following levels: minimum state liability, 50/100/50 liability, and 100/300/100 with full $500 deductible and collision. These hypothetical drivers have clean records and good credit. Average prices are for comparison. Your personal rate depends on your personal reasons and vehicle.

As you shop around for the right insurance company and price, you should also know what coverage is right for you. If this is a new policy, you must at least meet your state’s auto insurance requirements.

If you want to find the cheapest auto insurance when shopping, look for the minimum amount of liability coverage your state allows. (The minimum amount of coverage required varies by state.) Keep in mind that some states require so little coverage that it may leave other assets you own, such as real estate or stocks, vulnerable to a lawsuit. – the disaster is public.

If you are switching policies, review your policy information to see if your current coverage is still good for you.

Why Should I Compare Free Car Insurance Quotes Online?

Comprehensive and collision coverage doesn’t break the budget. A comprehensive comparison analysis of car insurance shows that the average annual premium is $192. Each collision costs $526.

Also,

Compare auto insurance online, online commercial auto insurance, auto insurance online comparison, best online auto insurance, shop auto insurance online, insurance quotes auto online, auto insurance online quote, online auto insurance companies, auto insurance online now, auto insurance online today, instant online auto insurance, discount auto insurance online