Health Insurance Plans – You will find the lowest price for health care insurance. Depending on your income and family size, you may also qualify for government rebates through the Affordable Care Act. Our prices can’t be beat.

We have made the process as simple as possible. Get accurate results in seconds without giving out your email or phone number. Use online tools to help you find the plan that’s right for you quickly. And register in minutes on your computer or your mobile device in a quick and easy online process.

Contents

- Health Insurance Plans

- How To Compare Health Insurance Plans

- Decoding Funded Health Insurance Plans: Myths Vs. Facts

- Unitedhealthcare Health Insurance Review

- Start Shopping: Enrollment Begins Nov. 1 For Most Obamacare Insurance Plans

- Buyer Beware: New Rule For Short Term Health Insurance Plans » Triage Cancer

- Health Insurance: Plans & Policies In India

- Individual Health Insurance Policy Ppt Powerpoint Presentation Layouts Ideas Cpb

- Fully Funded Vs. Self Funded Group Health Plans Comparison

- Family Health Insurance Plan

- How To Choose A Health Insurance Plan From An Employer

- Gallery for Health Insurance Plans

- Related posts:

Health Insurance Plans

Health insurance is one of the most important things you will ever buy. Comparing health plans and getting private health insurance quotes and information has never been easier. Thanks to the Affordable Care Act, also known as Obamacare, you have consumer protection on your side.

How To Compare Health Insurance Plans

Before 2014, a person could buy an individual health insurance plan at any time of the year. But from now on, one can buy individual health insurance during open enrollment, except in special circumstances.s

Obamacare law requires more people to have health insurance. If you are not enrolled in a health plan that meets the minimum requirements for the Affordable Care Act, you can change plans.

This law requires most Americans and legal residents to have health insurance that meets the standards set by the Covered California Exchange. Those who do not have health insurance can be fined.

For some, private health insurance is the only way to meet ACA requirements. If you have the option of group health insurance, a private health insurance plan may be the best option. It all depends on the plan that will best suit your needs.

Decoding Funded Health Insurance Plans: Myths Vs. Facts

Each health plan is different in how they are structured and how much they pay for your medical expenses. Under the ACA, all health plans must meet certain coverage requirements, which means that no one can be denied during open enrollment for a pre-existing medical condition.

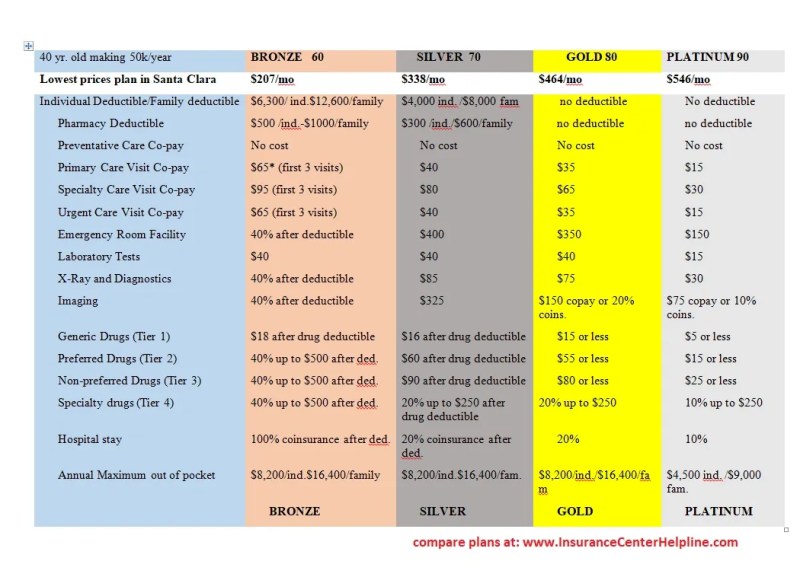

Health plans are divided into five main categories to facilitate comparison. These categories are classified based on the percentage of health care costs they pay, and they include the following:

Choosing a private health insurance plan that fits your needs depends on a few different factors. Consider the following aspects and determine how they will affect your plan:

Before buying private health insurance, you need to think about your health care needs and budget. Then compare different plans to find the right one. Here are some questions you should consider.

Unitedhealthcare Health Insurance Review

Consider your budget and your health care needs, and find out how much it will cost you in insurance and out-of-pocket costs for each plan you consider. Covered California makes it easy to compare different plans and choose the one that fits your health needs and budget.

Making the right choice in health insurance isn’t easy, but the research you do now will pay off later when you need health care for yourself and your family. Take advantage of our online service at the Health for CA Insurance Center to get free, instant access to California health insurance plans for individuals. Just fill out our privacy form to get started.

Not sure how Obamacare affects your health care plan in California? Learn how the ACA works in California, including benefits, costs and enrollment.

Covered California is the Golden State’s official health exchange marketplace where individuals, families and small businesses can find affordable, affordable California health insurance.

Start Shopping: Enrollment Begins Nov. 1 For Most Obamacare Insurance Plans

Learn about the Obamacare financial guidelines in California with our financial limits chart, and see if you qualify for government assistance.

Learn about the California Covered website. Find easy online registration. Set up your account, register, buy insurance and more on the California Health Marketplace website. It’s a new resource for everyone affected by childhood cancer – patients and their parents, family and friends.

Most health care in the United States is paid for by health insurance. An individual or family contracts with a health insurance company to help cover their health care costs.

When covered by an insurance policy, the policyholder pays a fixed amount, or lump sum, to the health insurance company on a regular basis. In return, the insurer agrees to pay an agreed-upon portion of the cost if medical care is required.

Buyer Beware: New Rule For Short Term Health Insurance Plans » Triage Cancer

Although every insurance plan is different, most health care plans have 3 components: benefits, network, and costs.

Costs vary depending on your health plan and the type of health care or prescription you receive. To learn more about health insurance costs, read about Common Health Insurance Costs.

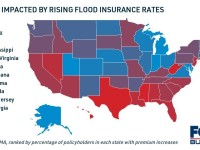

You can buy your health insurance directly from the insurer. Or you can buy it through a health insurance marketplace run by the state or federal government. The cost and number of plans vary by state. Find more details on sales by state.

With employer-based insurance, your employer can pay all or part of the health insurance. Often, your employer will offer several health insurance plan options.

Health Insurance: Plans & Policies In India

Two main types of public insurance programs cover families and children: Medicaid and the Children’s Health Insurance Program (CHIP).

Medicaid is a government health insurance program for low-income people. It covers children, the elderly, the disabled and other eligible people who receive federal benefits. Employer-provided health insurance is a huge benefit — if not a must-have — for job seekers in the United States. According to a study by the Society for Human Resource Management, 46% of employees with an employer-sponsored health insurance plan are either a determining factor or a positive influence in choosing their current job. Also, 56% said whether or not they like their health insurance is an important factor in deciding to stay at their current job.

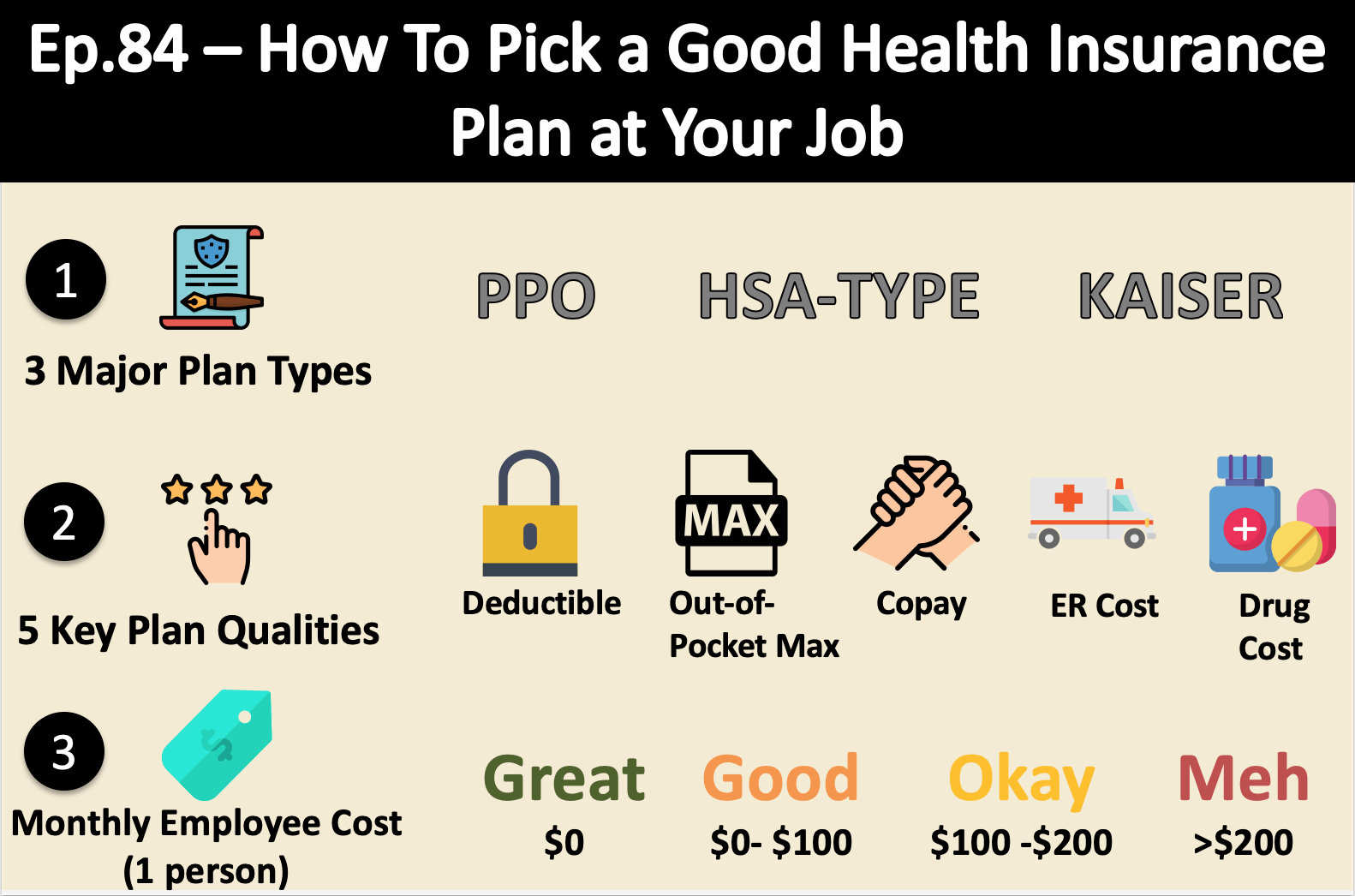

Even if you know that you want to take advantage of your company’s health care, you may feel that you are lost at sea when it comes to choosing the right insurance plan for you and your family. In this article, we will break down some of the key factors to consider to help you evaluate your options.

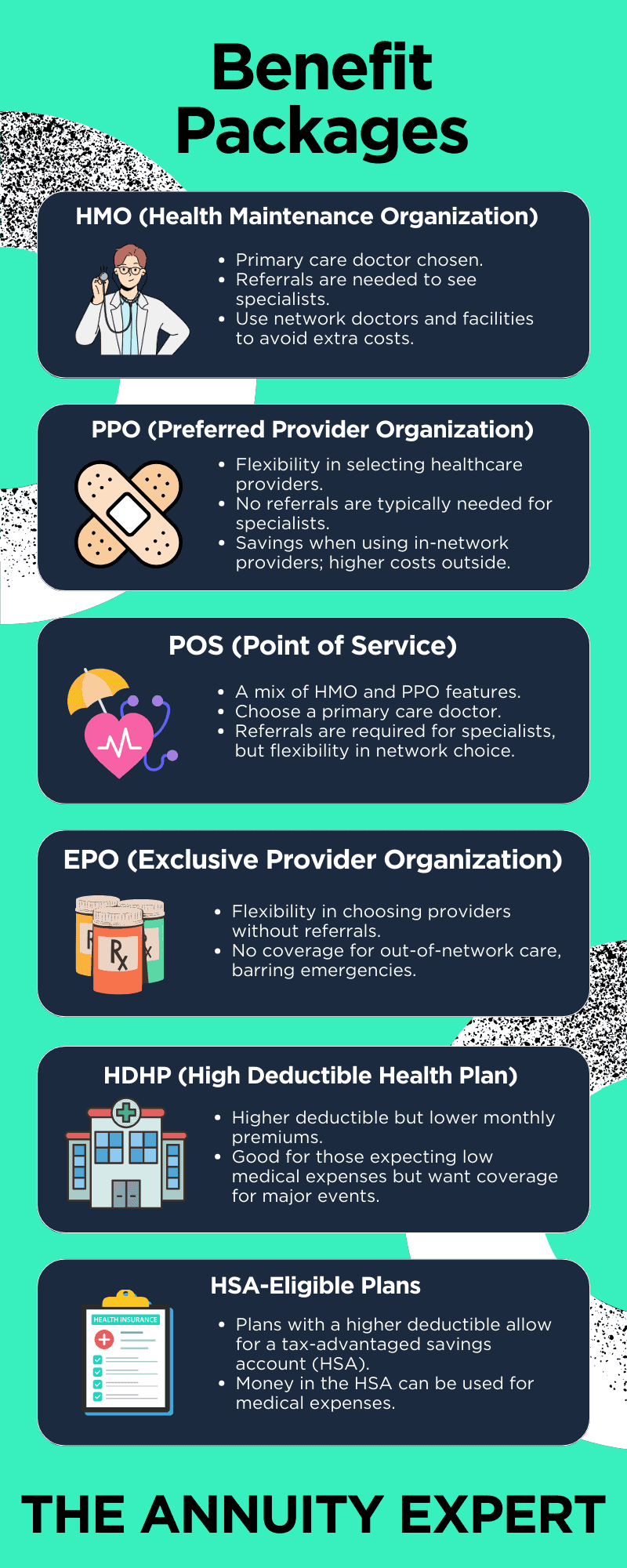

One of the main differences between plan types is whether or not they offer some type of out-of-network coverage.

Individual Health Insurance Policy Ppt Powerpoint Presentation Layouts Ideas Cpb

In short, a network is a group of health care providers – doctors, hospitals, laboratories, and others – with whom the insurance company contracts to provide services to the members of the health insurance plan. These companies and doctors must meet certain accreditation requirements and agree to accept discounted rates for services covered under the health plan to be part of the network.

Out-of-network providers do not have contracts with your health plan and may charge you full price for their services.

Another big difference is whether the plan requires you to get a referral from a primary care physician (PCP) to see a specialist.

Fortunately, HealthCare.gov offers great coverage! Here are a few of the big ones you need to know.

Fully Funded Vs. Self Funded Group Health Plans Comparison

This is the amount you pay each month for your health insurance. Your employer may cover part or all of your monthly premiums.

Keep in mind that less money doesn’t necessarily mean more money. Depending on your health care needs, paying a little more each month can mean a better plan and more security at the doctor’s office.

Your deductible is the amount you pay for covered health care services before your insurance plan starts paying. For example, with a $3,000 deductible, you pay the first $3,000 of covered services.

After paying your premiums, you usually only pay copays or coinsurance for services that are covered and your insurance company pays for others.

Family Health Insurance Plan

Your out-of-pocket limit or out-of-pocket limit is the maximum amount payable for covered services during the plan year. After you spend this amount on copays, deductibles, and coinsurance for out-of-network care and services, your health plan pays 100% of the covered cost.

A co-pay is a fixed fee that you pay each time you visit your doctor or fill a prescription. The cost of your visit is covered by insurance.

Types can happen in two ways: immediately or when you meet your own risk. If your copay only applies after your printout is done, you’ll pay out-of-pocket for your doctor’s visits until you meet that number. If they apply directly, you will only pay the zero amount when you visit, regardless of whether you meet your deductible.

Coinsurance is the percentage of covered health care costs that you pay after your premiums are paid. You will pay this percentage until you reach your pocket limit.

How To Choose A Health Insurance Plan From An Employer

For example, the normal deposit rate is 20%. This means that after you get your money, you pay 20% of your health care costs and the insurance picks up the other 80%.

Now that you have a better understanding of how the different strategies work, start thinking about how you hope to use your strategy. This is often the most important part of the process, as the best plan for one person may be the worst option for another depending on the needs of the individual or family.

If you are normally healthy and find yourself alone, see a doctor

Temporary health insurance plans, employer health insurance plans, private health insurance plans, dog health insurance plans, company health insurance plans, pet health insurance plans, aarp health insurance plans, group health insurance plans, health insurance plans ohio, corporate health insurance plans, texas health insurance plans, humana health insurance plans