Long Term Care Insurance – While our focus is on assisting families with the funeral and burial process and connecting families to available resources when they need them, there is an increasing number of requests from families to help care for their sick loved ones long before the funeral. It will be taken into consideration. This is especially true for “Sandwich Generation” caregivers. Middle-aged men and women who are caught between caring for their young children and caring for elderly and sick parents are known as the “sandwich generation.”

Kim Parker, “The Sandwich Generation: Rising Financial Burdens for Middle-Age Americans,” Pew Research: Social and Demographic Trends, January 30, 2013. These caregivers are often among questions about nursing home, retirement community, and hospice care. , insurance claims. The hope of this article is to reduce bewilderment and confusion, and provide answers to some of these questions for the Sandwich Generation and others. With the goal of being a resource for families on a variety of topics, we hope to alleviate anxiety surrounding end-of-life issues.

Contents

- Long Term Care Insurance

- Understanding The Difference Between Hybrid And Traditional Long Term Care Insurance

- Things You Should Know About Long Term Care Insurance

- Best Long Term Care Insurance Companies In December 2023

- Long Term Care Insurance: Faqs About What Determines Cost

- Gallery for Long Term Care Insurance

- Related posts:

Long Term Care Insurance

Essentially, long-term care insurance is a way for seniors or families to pay for nursing home, assisted living, or retirement benefits. Although the industry is relatively new and developed, it has gained momentum in recent years.

Understanding The Difference Between Hybrid And Traditional Long Term Care Insurance

, Laura Santhanam, “Exploring the Complexities of Long-Term Care Insurance Policies,” PBS Newshour, January 9, 2015. This privately purchased insurance reduces the financial burden of paying for care when a loved one cannot live at home. Long-term care can be exhausting, with annual costs for nursing homes and assisted living ranging from $40,000 to $80,000 on average depending on the level of care required.

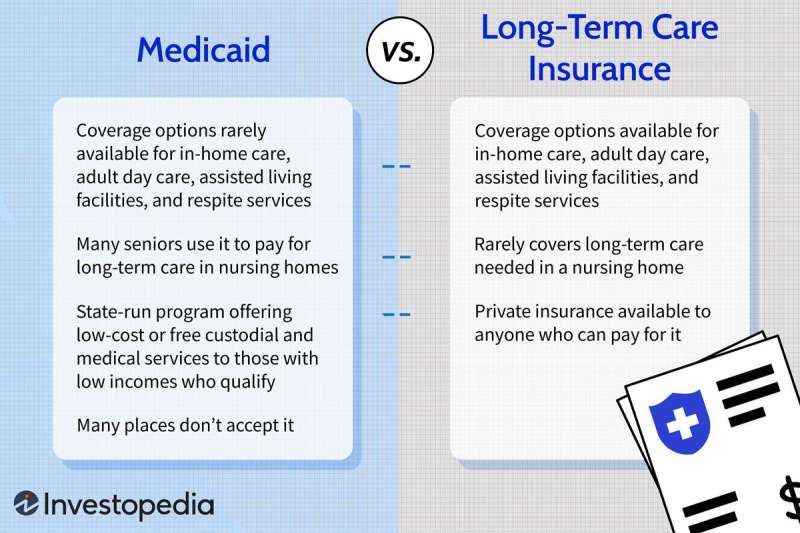

Many families struggle with personal savings, pensions and annuities not allocated for long-term care expenses, and end up in personal debt to pay for their loved ones’ care. Many seniors use Medicare to help with health care costs, but Medicare does not cover long-term care arrangements. Many seniors will need to apply for Medicaid or private long-term care financing. This is where long-term care insurance seeks to provide coverage.

The annual cost of care should purchase long-term care insurance. However, the complexity of long-term care insurance paints a different picture. Most of these insurance plans have several requirements that the insured must meet before the insurance will cover the expenses. For example, the insured may need to experience “impaired activities of daily living” such as bathing, brushing teeth, or using the toilet before receiving policy benefits. Consider purchasing an insurance policy for early-onset dementia or Alzheimer’s disease.

Likewise, someone who does not need to move into an apartment full-time but appreciates home supervision should check to see if long-term care insurance and its benefits can help cover daily nursing costs. Daily home health care costs average $45,000 per year, and if a family is unable to fund these costs individually, a long-term care insurance policy can reimburse the family for all or part of the $45,000. .

Things You Should Know About Long Term Care Insurance

Families who can pay for long-term care for a few months on their own should consider getting long-term care where they leave their personal finances behind. Many families are able to afford two or three months of care, but less. Long-term care insurance can fill these gaps because Medicare does not cover any of the costs and Medicaid requires income requirements before being approved for coverage.

Perhaps most importantly, any older person living with any type of chronic illness or “fair-for-the-poor” diagnosis should talk to their loved ones about long-term care. Consider Verna’s story. Verna was diagnosed with early-onset dementia after suffering a stroke. For a while, Verna lived safely at home and required minimal supervision. As her symptoms progressed, Verna’s ability to care for herself declined and she required nursing home care. Verna was 85 years old when she entered the nursing home. Despite his diagnosis, his doctor thought he was healthy and predicted he would live at least ten years. Ten years of nursing home costs of $45,000 a year could easily drain his life savings and any retirement account he has left. Verna was grateful that her children chose to purchase long-term care insurance as soon as they received the diagnosis, because it greatly eased the financial burden of paying nursing home bills for ten years.

Verna’s example underscores the importance of discussing long-term care decisions with her family immediately after diagnosis, and while her body and mind are still relatively healthy. Verna had enough to initially decide to purchase long-term care insurance, but if she avoided the topic altogether, her children and family would face enormous financial consequences as a result of ten years of long-term care. The decision to transfer him to another care facility, or to another level of care, could have been left up to his family, depending on the family’s resources.

Many local senior centers have information about long-term care insurance. In addition, any AARP member can easily find resources and compare costs on its website or by calling 1-888-OUR-AARP. Often, military veterans can use VA hospitals and associations to determine what types of care are covered under VA benefits and what additional policies they should purchase. Many states have government-supported programs that can provide additional resources for long-term care insurance. Again, to determine if there are contacts in the community, an aging agency or local senior center is the best place to see if there is a list of resources available to the family.

Best Long Term Care Insurance Companies In December 2023

Obtaining long-term care insurance is similar to obtaining any insurance policy. Be prepared to answer standard questions about contact information and emergency contacts, as well as financial questions, health-related questions, and questions of personal interest. For example, some insurance policies may not cover fully private rooms in a nursing home, but others may not. By asking the broker what services are covered, the family can consider the options available to their loved one.

This is perhaps the most difficult question to answer. As with funerals and burials, costs vary by provider and state. When considering purchasing long-term care insurance, families should prepare a list of ten facilities that will provide care. When visiting each facility, a family should note what coverage is available, what services are available, what the facility recommends, and whether it is a “right fit” for their loved one. In addition, many long-term care policies do not take effect until the insured remains in the facility for a few days, so families should ask about day care rates. With all of this in mind, families should be able to narrow down the list of services that are right for them, as well as narrow down the long-term care insurance companies they want to look into.

Some insurance companies provide a national list of organizations that offer specific coverage. For example, United Policyholders in California has created a database of insurance resources, costs, and programs for residents of that state. The AARP resources listed above allow consumers to compare and learn about acceptable policies before going to a care facility or nursing home.

As in the previous section, the answer to this question is a very vague, “it depends.” The premium price depends on the person’s age and health at the time of purchase and the type of insurance required. Costs vary depending on insurance company and age at purchase. In 2008, the average annual cost of long-term care insurance for a forty-year-old was $2,050, and $3,109 for a sixty-year-old.

Long Term Care Insurance: Faqs About What Determines Cost

, AARP “Long-Term Care Planning: Your Resource Guide,” 2010. Compared to the $45,000 annual cost mentioned earlier, $2,050 or $109 doesn’t seem like a bad investment.

Buying long-term care insurance is much like shopping for other types of insurance, and it pays to buy the best comprehensive policy at the best price. As with car insurance, the family should not be surprised if the family pays a small portion of the loved one’s expenses and the family needs to start saving again. Likewise, a more comprehensive policy may have higher annual premiums but still cover ninety percent of your loved one’s care. Every insurance agent or broker should be able to answer your family’s questions before purchasing any insurance policy.

In addition to the financial difficulties and trauma of subjecting a loved one to long-term training

Buy long term care insurance, top long term care insurance, long term care insurance quote, get long term care insurance, senior long term care insurance, long term care insurance agent, long term care insurance colorado, long term care insurance arizona, affordable long term care insurance, long term home care insurance, aarp long term care insurance, long term care insurance florida