Buy Life Insurance – Buying life insurance is not what people expect. Despite this, executives understand the need to make purchases (sooner rather than later).

As you learn more about the life insurance industry, including the options available, it’s natural to feel overwhelmed by all the details. From cost to coverage to hundreds of companies, it’s not always easy to make a final decision.

Contents

- Buy Life Insurance

- When Should You Buy Life Insurance?

- Life Insurance And The Millennial Generation

- Buy A Life Insurance Policy When You Are Young. Here’s Why

- Can You Guess The Top 5 Reasons People Buy Life Insurance?

- When Is It Too Late To Buy Life Insurance?

- Should I Buy Whole Life Insurance?

- Benefits Of Buying Life Insurance Online

- September Is Life Insurance Awareness Month

- Gallery for Buy Life Insurance

- Related posts:

Buy Life Insurance

Fortunately, using the Internet can simplify the process. This allows you to put your mind at ease as you make decisions that affect you and your family both now and in the future.

When Should You Buy Life Insurance?

You’re not alone if you don’t know the benefits of buying life insurance online. While you may not have much knowledge right now, it doesn’t take long to realize how the Internet can change your behavior for the better.

Let’s face it: The last thing you want to do is spend hours on the phone with life insurance agents and brokers. By the time you finally get on the right track, you’ll be too tired to make a final decision.

It doesn’t matter who you are or what type of life insurance you are looking for; Nothing changes the fact that you want to save money on your purchase. You know what you want, you know what you need. You also know that you have to stay on budget.

You can save money by searching online, as it gives you the ability to compare thousands of quotes. As a result, you can also narrow your focus and choose a policy with the best coverage at a reasonable price.

Life Insurance And The Millennial Generation

Unfortunately, many people only buy term life insurance because they can’t get past the low cost. Any insurance is better than no insurance, but you don’t want to miss out on the best policies.

When you buy life insurance online, it’s easy to learn more about your options, including life coverage. It won’t be long before you realize that you can buy a whole life policy at a price you can afford. Will it change your behavior? It should.

Have you purchased any insurance before? If so, you know one thing is true: agents and brokers will harass you day after day until you provide more information. Some won’t even stop once you tell them you shopped elsewhere.

When you shop online, all the hassle and stress goes out the window. You don’t have to deal with it anymore. You are responsible for your situation, which means you should not provide more information than you are comfortable with.

Buy A Life Insurance Policy When You Are Young. Here’s Why

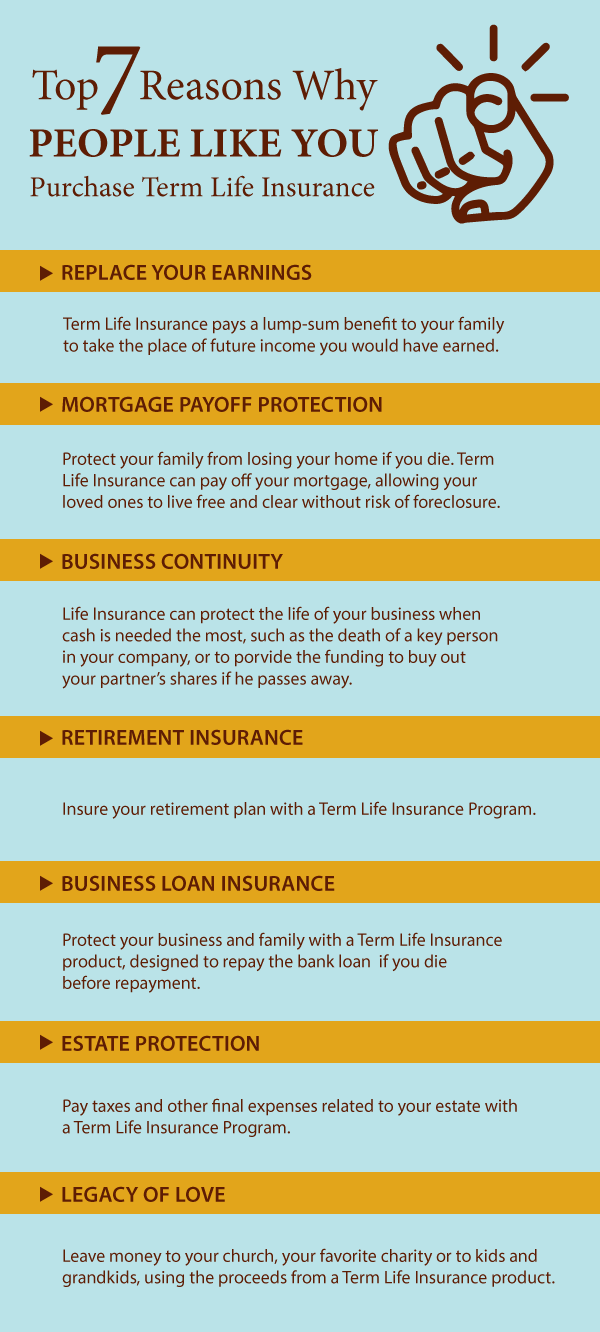

Life insurance is not something you buy for yourself. This is what you buy for your family. Your loved ones will receive a death benefit when you die.

It can be difficult to take more with you when buying life insurance personally. The same goes for shopping over the phone.

However, with online access, you don’t have to worry about that. You can include anyone you want. Start by asking for quotes. From there, share them with your loved ones. Getting feedback from someone you trust can only improve the process.

Now that you fully understand the benefits of buying life insurance online, it’s time to get started. There are many different types of policy. Many insurance companies want to do business with you. And of course, you should focus on your personal details, such as how much you want to pay for the policy.

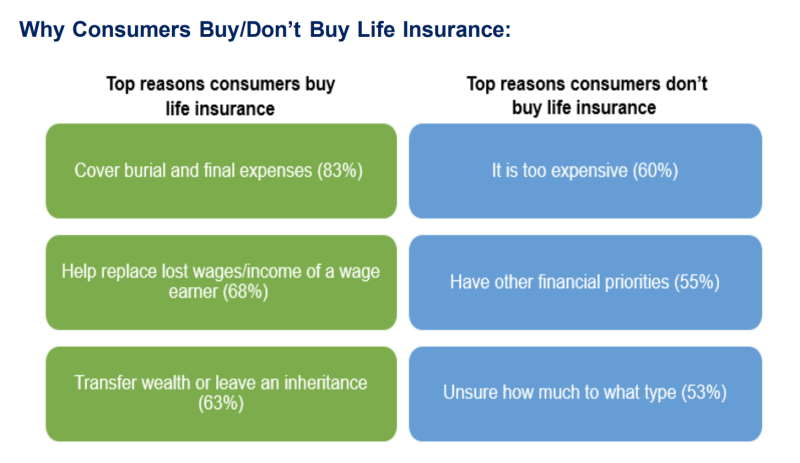

Can You Guess The Top 5 Reasons People Buy Life Insurance?

If nothing else, give the internet a second look. Like many of you, don’t be surprised if you realize that buying life insurance online is the best thing you can do. By clicking “Accept All Cookies”, you consent to the storage of cookies on your device to improve site navigation, analyze site usage, and assist in our marketing efforts.

Life insurance is a contract between an insurance company and a policyholder in which the insurer promises to pay one or more beneficiaries, when the insured dies, in exchange for the life of the insured. Pays in term. The best life insurance companies have good financial strength, low number of customer complaints, high customer satisfaction, wide variety of policies, available and included riders, and easy applications.

There are many different types of life insurance to suit all needs and preferences. Depending on the short-term or long-term needs of the insured person, it is important to consider the actual choice whether to opt for short-term or permanent life insurance.

Term life insurance is designed to last a certain number of years, then expire. You choose the term when you buy the policy. Common terms are 10, 20 or 30 years. The best term life insurance policy balances affordability with long-term financial strength.

When Is It Too Late To Buy Life Insurance?

Most life insurance policies allow you to renew the contract annually after the end of the term. This is one way to extend your life insurance coverage, but since renewal premiums are based on your current age, they can quickly increase each year. The best solution for permanent coverage is to convert your life insurance policy into a permanent policy. This is not an option in all life policies; Check the flexible term policy if this is important to you.

Permanent life insurance is more expensive than term, but it remains effective for the life of the insured unless the insured stops paying premiums or surrenders the policy. Some policies allow auto premium loans when premium payments are late.

When shopping for insurance, you might want to start with our list of the best life insurance companies, some of which are listed below.

Term life insurance differs from permanent life insurance in several ways, but meets the needs of many people looking for affordable life insurance coverage. Term life insurance lasts only for a fixed term and pays a death benefit in case the insured dies before the end of the term. This is in contrast to permanent life insurance, which remains in effect until the policyholder pays the premium. Another important difference involves premiums – term life is usually

Should I Buy Whole Life Insurance?

Before you apply for life insurance, you should analyze your financial situation and determine how much money will be needed to maintain the standard of living of your beneficiaries or meet the need for which you are purchasing the policy. Also, consider how long you will need coverage.

For example, if you are the primary caregiver and have children ages 2 and 4, you will want enough insurance to cover your caregiving responsibilities until your children are grown and able to support themselves.

You can look at the cost of hiring a nanny or housekeeper or the cost of using commercial babysitting and cleaning services, then maybe add money for tuition. Include all of your spouse’s mortgage and retirement needs in your life insurance calculations—especially if your spouse earns significantly less or is a stay-at-home parent. Add up those costs over the next 16 years, add more for inflation, and that’s the death benefit you’ll want to take — if you can afford it.

Burial or final expense insurance is permanent life insurance with a small death benefit. Regardless of the names, the beneficiaries can use the death benefits as they wish.

Benefits Of Buying Life Insurance Online

Many factors can affect the cost of life insurance premiums. Some things may be out of your control, but other criteria can be managed to reduce the cost before (and even after) applying. Your health and age are the most important factors that determine cost, so buying life insurance as soon as you need it is the best course of action.

After the insurance policy is approved, if your health condition has improved and you have made positive changes in your lifestyle, you can request to be considered for a change in risk level. Even if you are found to be in bad health at the time of initial inception, your premium will not increase. If it is found that you are in good health, your premium may be reduced. You may also be able to purchase additional coverage at a lower price than you did initially.

Consider what expenses will be covered in the event of your death. Consider things like mortgages, college tuition and other debts, not to mention funeral expenses. Additionally, income replacement is a big factor if your spouse or loved one needs cash flow and can’t provide it themselves.

There are helpful online tools for calculating an amount that can provide for any potential expenses that need to be covered.

September Is Life Insurance Awareness Month

Life insurance applications usually require personal and family medical history and beneficiary information. You are required to undergo a medical examination and are required to disclose any existing medical conditions, history of traffic violations, DUIs and any dangerous hobbies, such as car racing or skydiving. The following elements are required in most life insurance applications:

Standard forms of identification

Buy life insurance online instantly, companies buy life insurance policies, buy term life insurance, where to buy life insurance, buy insurance life, buy whole life insurance online, buy life insurance online, buy whole life insurance policy, best life insurance to buy, buy a life insurance policy, buy a life insurance, buy whole life insurance